I’ve read that there are as many as 15,000 vacant buildings in the city of Chicago. This wouldn’t be so bad if someone took responsibility for maintaining them and the associated property. However, all too often the owners abandon the buildings which steadily deteriorate, create a really nasty looking neighborhood, and become crime scenes. Having an abandoned building in the neighborhood also significantly depresses neighboring home values as you might imagine.

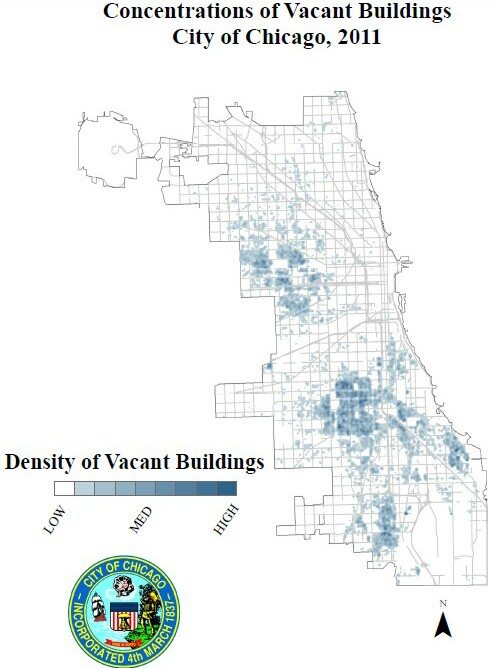

The map below shows where the vacant buildings are concentrated in Chicago. As expected they mostly fall in the western and southern neighborhoods.

So what can the city do about this problem? The problem sure seems intractable when you consider the dynamics that often lead to building abandonment. A typical scenario is that the owner becomes delinquent on their mortgage and eventually gets a foreclosure notice at which point they abandon the building. This is where the story gets a bit fuzzy for me because from the time you get your first foreclosure notice you can easily live for free in “your” home for another year or two or more. So why abandon it? Maybe they don’t know any better? Or maybe they have no intention of maintaining a building they are about to lose so they let it become uninhabitable? But the point is that the owner is not going to maintain the property either because they have no money or because they have disappeared.

So politicians do the only thing they know how to do, which is pass laws. In this case we are talking about the Vacant Property Ordinance. That link only goes to a summary of some of the key points, the gist of which is that the owner of the building must maintain the building according to some minimum standards, which involves spending money. And if they don’t comply they can incur fines of up to $1000/ day. Hint: if there is a troublesome vacant building in your neighborhood use this ordinance to put the squeeze on the owner.

But, as I said, the owner usually doesn’t have any money so the politicians have further decided that the lenders should take on responsibility for these vacant properties even before they have foreclosed upon them. And that’s where they opened a real can of worms – or at least a legal quagmire. How in the heck are the banks supposed to maintain properties they don’t own? Are they supposed to trespass? Make modifications to a property that someone else technically owns? And if lenders are going to incur these higher costs are they going to start charging more for mortgages in Chicago or abandon the market all together?

Predictably this is creating a huge problem, which has now culminated in the Federal Housing Finance Agency suing the city of Chicago on behalf of Fannie Mae and Freddie Mac. Here are some of the objections they are raising: 1) Fannie and Freddie can’t be expected to maintain properties they don’t own and 2) “the city’s ordinance impermissibly encroaches upon FHFA’s role as the sole regulator and supervisor of the GSEs” and 3) “the registration fee represents a tax on the Enterprises and the Conservator that is expressly precluded by long-standing congressional directive.”

I can’t say for sure what the right solution is for this problem except holding the lenders accountable for maintaining someone else’s property doesn’t seem to be the right solution. Maybe the city should have the right to bulldoze the building and take possession of the land. If you have a better suggestion let me know.

0 thoughts on “What Should Chicago Do With 15,000 Vacant Buildings?”

Leave a Reply

You must be logged in to post a comment.

Legalities are just things to “get around”.

That is how things are done locally and now nationally.

Of course, the point can be made that most banks do not own the note that mortgage payers are paying. In fact, most banks are just “servicing” the mortgage accounts for another entity, including but not limited to Freddie and Fannie.

Initial lenders will stop underwriting in the market, yes. And then the entire mortgage system will default to the federal government. Then more ordinances can be passed that make no sense legally but appear good on the surface to local voters.

Ironic, no, when you consider Mayor Rahms role in all this?

Want to get your mortgage bank flustered? Ask who or what is actually holding the “paper” or the note.

Legalities not aside, I fail to see how the city has the jurisdiction to regulate federal entities, and thus odds are the federal court is going to strike this down, at least as applied to them. However, various Illinois legislative bodies show that they have no reluctance to pass unconstitutional laws–take McPier, for example, and this probably is another one.

The real question is that, since the map validates my point of a couple of days ago that people are moving out of the south and west sides, added to the prior burning of such areas as Woodlawn and Grand Boulevard, and people shooting up South Shore, Chatham, and West Pullman, what is the city going to do with vast swaths of vacant property? I suppose it can look to Detroit for guidance, which may be an indicator of how bad things are becoming in various parts of Chicago.

If the city was smart (big assumption) they would promote development in the closer in neighborhoods where they have a lot of vacant land. I live in University Village and we think it’s great. From what I understand it wasn’t always that way.

Well, they sure have a lot of lots to develop, including after tearing down most of the high rise public housing. The question is whether any builder thinks there is economic sense to develop them. Are you showing clients vacant property around 47th and Federal, or 56th and Halsted, for example?

Well, no one is interested in buying a home surrounded by empty lots or boarded up buildings. However, if they develop an entire area like what they are doing along Division then people are interested.

At least people were always interested around Division. The cry of the remaining Cabrini-Green residents was that they are moving us out for the yuppies. On the south side, apparently they moved them out for very little in replacement, and apparently a large number of Black former Chicago residents have left the state.

You say, “if they” without saying who “they” are. Is the city supposed to build thousands of new houses and hope people move into them? I thought you were making an argument for a free market, but since you say that “no one is interested in buying a home surrounded by empty lots or boarded up buildings” it sure sounds like you don’t have any “limited government” solution. After all, some government unit will not own the foreclosed property until such time as there is a tax foreclosure and not even the tax scavengers will be interested in it. That is, unless you are advocating bringing back 1950s style condemnation and “urban renewal,” and that doesn’t seem to have worked, either, except near existing institutions, such as Lake Meadows or 55th near the U of C.

They is some kind of private/ public partnership like I imagine happened in University Village. You need a way for a developer to get their hands on a large block of land. Not sure how that happens but if it requires tax incentives then so be it.

While at least you make it clear that you don’t mind some sort of government involvement, University Village is similar to the ones I mentioned above–there is at least some institution that anchors the community and may be a source of employment for residents (UIC and the Medical District).

I don’t think that the inability to assemble parcels is a problem in the demolished CHA tracts, nor relevant to rehabilitation of the numerous single family foreclosures. However, some demand to live in those neighborhoods is. That would seem to be the first law of economics. Maybe some government intervention would eliminate the blight and give someone a reason to live there, but the scope of the problem, in the number of foreclosures (the headline of this piece) and vacant lots, and the nature of some of those neighborhoods, seems to negate that.

If you are talking about neighborhoods where the homes are not that nice and there are a few vacant buildings scattered around then I agree. The demand would not be there. However, there are parts of Bronzeville where it’s mostly vacant land/ buildings and if a developer came in with a large, contiguous development I think the demand would be there. But I’m not sure how you put the pieces all together without driving the price up.

Don’t worry. The Democrats will soon have Chicago resembling Detroit.

Since we are out of buttons:

“But I’m not sure how you put the pieces all together without driving the price up.”

Well, either that is the economic cost of the development, or you have the government in effect confiscating it by condemnation, and paying “just compensation” based on the decrepit condition of the property and currently depressed real estate values. In the latter case, even if the government can resell it, either the project doesn’t get off the ground (I know of examples in the suburbs where the developer bought up the property and went through the zoning process, but still built nothing), or John Kass will write that it is a sweetheart deal (as in the case of the former Limits bus barn), especially if the developer does not pay the government for the value added by its assembly and clearance of the land.

That also assumes that somewhere like Bronzeville needs high density development as opposed to single family housing or low density townhouses.

You still have not addressed the underlying problem of lack of demand.

Yeah, the buttons run out at some point.

I wasn’t suggesting that Bronzeville needs high density development but if you want to build single family homes or townhomes you will want all the homes in the neighborhood to be of similar quality and age. If you create that type of environment I believe the demand will materialize. Bridgeport Village was another example of a great concept. Those sold pretty well. Unfortunately, the development is not big enough and it had other quality issues. When I say not big enough I mean that it’s surrounded by housing of even lower quality.

Lack of demand is and will be the key.

Demographics are changing, incomes are flattening, attitudes regarding ownership have been undermined by steep losses in home equity, and Chicago and a lot of Illinois people are nearing the point of no return in taxing and aggravating its citizens with fees upon taxes upon regulations upon non-responsive government.

The overall state of the state of Illinois is in its last of the last state credit ranking by Moody’s.

The direction home for many will be to other states.

What difference does it make who owns the note? The borrower got the money to buy the house and if they don’t pay the lender (whoever that is) gets to foreclose. A mortgage is a very simple thing.

The lots could be re-claimed as park land or wilderness.