I had to really think hard before I led with this post title. Notice I didn’t say that location doesn’t impact Chicago real estate values. But when it comes to the most important factors in determining real estate values maybe it’s not really location, location, location. After all finishes, quality of construction, age, and size play a huge role. In fact, size is the most important factor – duh!!!

I’ve been working with some investors lately so I’ve become obsessed with figuring out where the best investment opportunities are. As such I’ve been comparing the cost of ownership to the cost of renting in various neighborhoods and looking for some kind of pattern that I can exploit – maybe find the Unified Field Theory of real estate. Well, nothing is ever as easy as it sounds. Surprisingly the pattern is nowhere near as clear as I would have expected.

I started with condos in West Town and Logan Square and didn’t find much of a pattern and then dug into Lakeview (actually it’s Lake View but most people spell it Lakeview) and Roscoe Village. Although I looked at the cost of ownership as well, I’ll just focus on rents here because there’s a lot less to explain with my methodology.

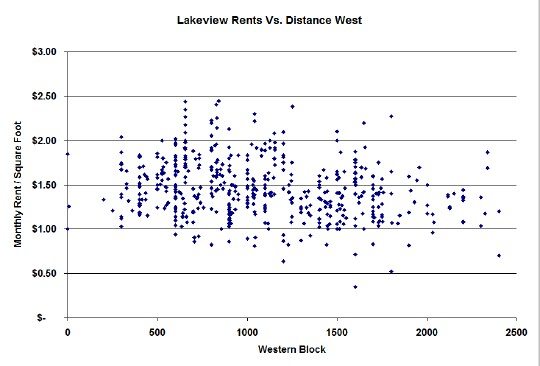

Backing out the value of parking at $200/month/space I calculated the rents/square foot for all the places rented in the last 12 months in either Lakeview or Roscoe Village and compared them based upon how far west they were. The results are plotted below. Each point represents one rental.

As you can see the variation in rents between places at roughly the same western coordinates is much greater than the variation from the eastern edge to the western edge of this area. Yes, rents do drift down as you head west but not nearly as much as I expected – maybe $.25/square foot? Statistically the western coordinate explains less than 6% of the variation in rent/square foot. This despite the fact that many people set up their searches with western boundaries like Southport, Ashland, or Damen – i.e. the farther west you go the smaller the pool of buyers/renters.

Oh…and I also checked the northern coordinate and found even less of a pattern.

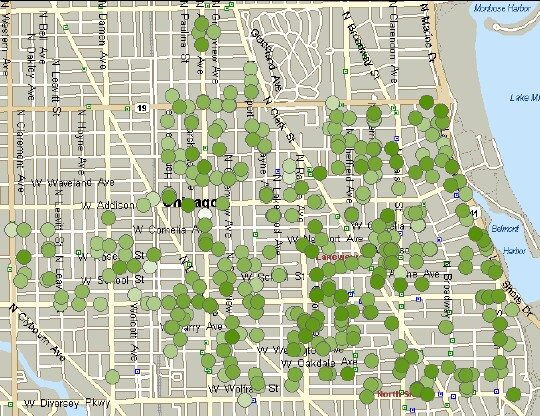

So I decided to take a closer look at location and plotted these same rentals on a map where the darkness of the circle represents the rent/square foot/month. Dark green is $2.00 or more and white would be $.20. Again a clear pattern is not apparent. Sure, the dots get slightly lighter as you move west but not by much. And you would expect that rentals near public transportation would garner a premium but that effect doesn’t seem that strong either. I was thinking that maybe being in the southwestern part of the Burley school zone offsets being farther from the el but I don’t think many renters have school aged children.

So what does influence rents if not location? Surely the level of finishes in a place and the quality of construction but that’s hard to quantify. I’m tempted to end this post like every academic paper I’ve ever read, with a statement like “More research is needed to explore these topics” but I won’t. Instead I’ll just say the obvious: at the end of the day it always comes down to what someone is willing to pay and what someone is willing to “sell” for and the real estate market can be quite inefficient at times. In other words, if you shop around hard enough you can probably get a place in a “better” location.