Although a lot has been written about the recent Chicago property tax bills there still seems to be plenty of confusion based on comments I’m seeing online. So let me try to simplify the issues succinctly.

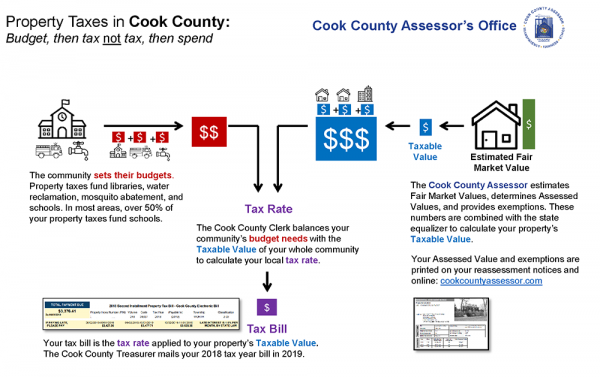

First, the new assessed values came out last year and huge increases in some values really freaked out a lot of people. However, in most cases the huge increases were well deserved because years of mismanagement by Joe Berrios had resulted in gross undervaluation of many properties, my house included. In addition, valuations had been artificially depressed because of Covid adjustments that folks sort of forgot about. But people also freaked out because they erroneously concluded that a higher valuation automatically meant higher taxes. But, as I’ve explained on numerous occasions, valuations don’t drive property taxes, the budget does. Valuations drive the allocation of property taxes amongst property owners. So if everyone’s valuations go up by 25% but the budget doesn’t change then nobody’s tax bill changes. Apparently this is a widespread source of confusion in Chicago because the Cook County Assessor put together this great graphic to explain how the property tax calculation process works:

Well, overall Chicago assessed values went up 18% from 2020 so, all else being equal, the effective tax rate was going to go down by around 15.3% (1-1/1.18). Of course, people like me that saw more than an 18% increase in their assessed value were going to get a tax hike while those with less than an 18% increase were going to get a tax reduction. Except that…

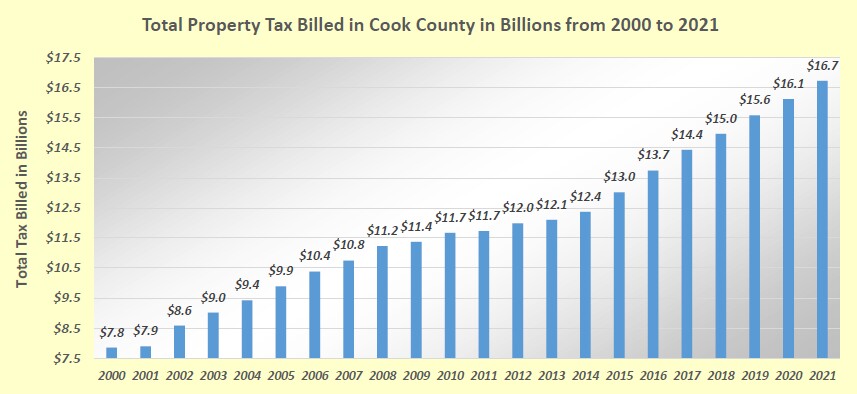

…not all else was equal. I know this is a shock but Cook County’s budget actually goes up every year and the 2021 budget went up 3.7% from 2020. So that was destined to drive up property taxes on average by a bit.

That graph comes from the 2021 Cook County Tax Rate report released December 5 – about 5 months late. In fact, another problem was that the whole tax process was running late last year with the actual tax bills coming out more than 150 days late due to political infighting and lack of cooperation between the Cook County Assessor’s office and the Board of Review. We’re going to revisit that head butting later.

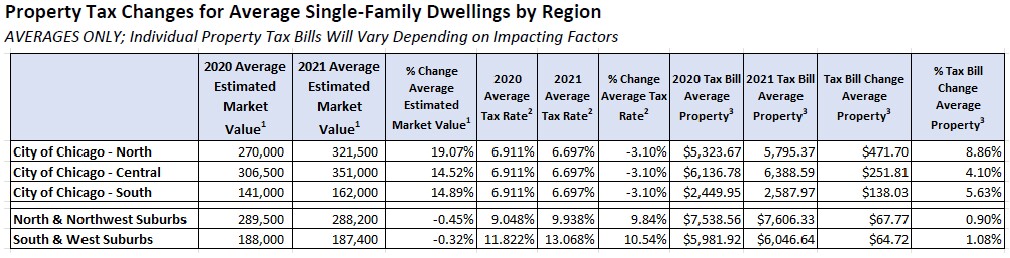

The Cook County Assessor’s office breaks Chicago down into three regions – north, south, and central. The table below summarizes the main factors driving changes in tax bills throughout Chicago and suburban Cook County.

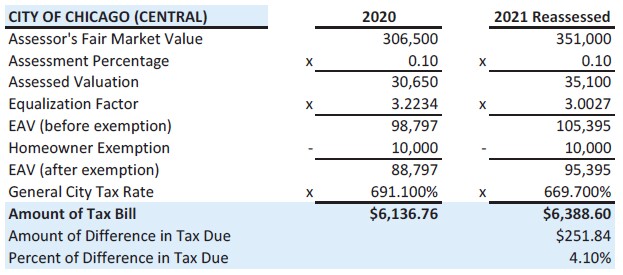

So notice how the percentage change in the average tax bill is substantially lower than the percentage change in the estimated market values. Here is the detailed calculation of taxes for the central region:

Note that there is a typo in their example – the decimal point in the general city tax rate is off by two digits. Also, let me simplify this calculation which has too many factors in it. The bottom line is that, before the homeowner’s exemption of $691 in 2020 the effective tax rate was roughly 2.2% of market value. For 2021 the homeowner’s exemption is worth $670 and the effective tax rate dropped to 2.0%. But the bottom line in this case is that a 14.5% increase in the average assessed value resulted in only a 4.1% increase in average taxes due. For the north and south Chicago regions the average tax increase was 8.9% and 5.6% respectively because of different increases in the average assessed value.

However, there is another layer of complexity to this story. Fritz Kaegi actually did a pretty good job of getting the assessed values right. As I wrote a little more than a year ago he fixed the chronic under-assessment of commercial properties that had plagued the process forever due to the incompetence of Joe Berrios. Had the process proceeded with Fritz’ numbers homeowners would have actually seen a significant reduction in their property taxes while commercial property owners would have seen a substantial increase. Unfortunately, as I pointed out in that blog post, the elected three member Board of Review overruled Fritz’ assessed values and shifted the tax burden back to homeowners. But you gotta love Fritz because back in November he used his platform to lay out the story clearly for all the voters to see on the Cook County Assessor’s Web site: Assessor’s Office Releases Report on Board of Review’s Changes To Chicago Tax Base. He places the blame squarely where it belongs. The good news is that 2 of the 3 members of the board were replaced in the last election. Here’s hoping that the new board will allow Fritz to do what he needs to do.