Not many real estate brokers will tell you what I am about to tell you:

- Most of the data you’ve been fed about housing price changes is grossly misleading

- Housing is not the great investment that the NAR (National Association of Realtors) wants you to believe

Let me give you some typical examples of the information that is out there on the subject of housing prices and the problems with this information. While the information is usually true in some way it is often misunderstood, and sometimes that is the intention.

Example #1

Two days ago the Tribune ran an article, “Home sales, prices decline statewide; city not as bad”, which stated that the median Chicago condo price in March rose 8% over last year. So what do you think that means? That condos in the city have appreciated 8% in this lousy real estate market? I don’t think so.

All it means is that the median price of a condo which sold in March was 8% higher than the condos that sold a year ago. But that doesn’t mean that the value of condos went up. More than likely it means that the mix of condos which sold this March is skewed more towards expensive condos. Maybe this year there are more 3 bedroom condos being sold and fewer 2 bedroom condos.

Example #2

According to the Tribune’s Real Estate Market Pulse, in Lakeview between 12/1/2002 and 2/28/2003 the median home sales price was $320,000 vs. $245,500 one year prior. Some people would look at the Lakeview data and conclude that housing in Lakeview appreciated by over 30% in one year. However, this is that median problem again.

Example #3

In late 2006 and early 2007 the NAR ran an ad campaign that stated, among other things, that “Housing is a great investment, with average home valuations increasing 88 percent in the last 10 years”. That works out to 6.5% per year on average (keep that number in mind for later). Of course, this 10 year period just happened to coincide with the most outrageous 10 year period of housing appreciation in the nation’s history, for which we are now paying the price. Unfortunately, they’re implying that home buyers can expect that appreciation going forward, which is absurd. This self-serving information appears to be intentionally misleading. But isn’t that the point of advertising?

Example #4

In late 2005 the Tribune published a map showing home price appreciation for each of the Chicago communities and some of the surrounding suburbs. One of the communities they highlighted was Uptown, where they claimed home prices had appreciated on average by 9% per year over 10 years, which is huge. In addition, they showed the 1996 price of a home (presumably the average?) as $121,918 and the 2005 price of a home as $265,000.

This example is interesting because not only does it suffer from the median or average problem that I’ve already addressed, but it also suffers from a math error that seems to recur throughout this map. The percentage change is wrong. For Uptown, given those home prices the average appreciation rate (if you can call it that) actually works out to 8.1% per year.

The Correct Way to Analyze Housing Price Trends

Fortunately, there is a more robust way to track housing prices. The S&P/Case-Shiller home price index tracks repeat sales of homes so that they can really tell if homes are appreciating and by how much. This index has been calculated for 20 metropolitan areas and Chicago is one of them, going back to January 1987. For each metropolitan area they calculate the index for low, middle, and high price tiers, along with a composite index.

The Chicago metropolitan area is defined broadly to include the counties of Cook, DuPage, McHenry, Kane, Kendall, Lake, and Will. In this area the pricing tiers are defined as:

- Low – Under $227,766

- Middle – $227,766 – $348,054

- High – Above $348,054

Here is what the data shows:

There are several points to note in this graph:

- Data for the individual tiers are not available prior to January 1992

- The lower priced tiers have appreciated more rapidly than the higher priced tiers. This makes sense in light of the “innovations” in subprime lending that spurred growth at the lower end of the market.

- The Chicago housing market peaked in September 2006, right around the time that the NAR came out with their great investment campaign. Since then prices have declined 9.1%. I guess it wasn’t such a great investment after all.

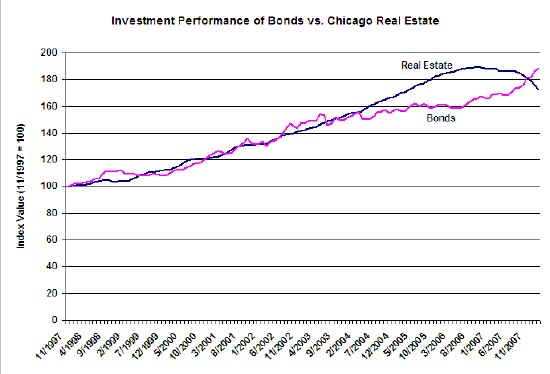

Speaking of investments, how has Chicago real estate performed as an investment? Case-Shiller provides comparisons of various asset classes such as stocks, bonds, commodities, and housing over the last 10 years, which has been a stellar time period for housing. I won’t bother to show you how Chicago real estate compared to stocks because we all know that stocks haven’t done that well during this time period. However, comparing Chicago real estate to bonds is a different story:

Basically, over this time period, you would have ended up slightly better off had you invested in bonds vs. Chicago real estate. However, there is a bit more to the story:

- The average appreciation of Chicago real estate from January 1987 to December 1998 was 3.7% per year.

- Starting in 1999 people thought they were rich (remember the tech bubble?) and they went on a home buying spree. In addition, this is approximately when subprime lending really took off.

- From January 1999 through the peak in September 2006 the growth rate jumped to 8.3% per year.

- To put all these percentages in perspective Robert Shiller (of the Case-Shiller Index) analyzed home prices going back to 1890. For the first 100 or so years of that time frame his data shows that the average appreciation of homes, after adjusting for inflation, was….are you ready for this? Zero!

Nevertheless, someone will always say “But I’ve owned my house for 3 years and my equity has doubled”. OK…but that has to do with leverage, and in the good ol’ days that leverage was 5:1. Since then it has sometimes been infinite. So if your house appreciates by 20% and you are leveraged 5:1 then your equity doubles. Of course, leverage works both ways. If your home depreciates by 20% then you are wiped out, and this has happened to a few people lately. It happened to me in New Jersey in 1993 (actually, I lost double my equity). However, if you like leverage, you can leverage investments in stocks, bonds, or commodities as well. It’s a great way to lose your ass.

OK. So why is a real estate broker telling you all this? Shouldn’t I be convincing you to buy, buy, buy? For one, I am sickened by the self-serving analysis of the real estate industry and I want to set Lucid Realty apart from this madness. Secondly, I want to make a really important point: Your house is not an investment. It is a place to live. Don’t buy a home primarily because of some perceived investment opportunity. You may or may not realize it. Of course, I’m not suggesting that you shouldn’t try to find the best value when shopping for a house. After all, that’s where we come in. It’s just that some people make the mistake of letting the perceived investment opportunity overshadow other considerations. Let me put it another way: what kind of investment is your car? And before answering that remind yourself that you don’t (normally) sleep there at night.

If you want an investment, there are plenty of much simpler ways to invest your money. And if you want a real estate investment then look to income producing property that you subject to rigorous financial analysis. In the meantime, if you want a place to tuck your kids into bed at night or have a group of close friends over please give us a call.

Your decision to purchase a home should not be based solely on the home as an investment. However, it simply must be a factor–particularly in today’s housing market. My husband and I purchased home we loved in Baltimore MD in 2006. We were planning to fix it up and live there for a long long time. However, less than 1 year later, he recieved a job offer here in Chicago he could not refuse. So. . .we are back in the market for a home, and our value has declined. We are renting, and purchasing a foreclosure as an attempt to offset a loss, but for now and probably over the next 3 to 4 years we view this home we loved at one time as a “white elephant” on our backs. This experience taught us to look for most of the things we really like in a home, its location, and its investment value.