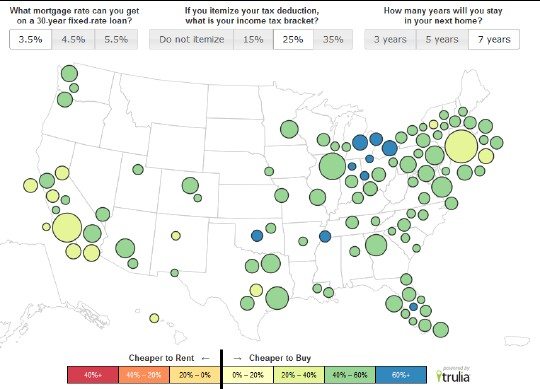

In the past week I must have seen at least 3 different news stories about how buying a home is better than renting a home. Most prominent among these stories was the Trulia blog post with the headline that Buying A Home Is 45% Cheaper Than Renting. The 45% number is the average savings associated with buying a home and living there for 7 years in the 100 largest metro areas. For Chicago Trulia concluded that buying is 50% cheaper. That blog post also links to this cool interactive graphic that shows how these two alternatives compare in different cities throughout the country. Clicking on the image below takes you to that graphic where you can roll over the circles to see the values for individual metro areas.

The values that Trulia calculates are based upon a number of assumptions and of course individual results may vary. That’s why I always recommend the New York Times tool that allows you to calculate the economics of renting vs. buying a home with your own personal assumptions.

I decided to run the calculator for the townhome that I had been renting in University Village that I’m assuming could have been purchased for $640,000. At the time my rent was a below market $3200/ month, only because we were long term tenants that always paid the rent on time and our landlords had not needed to refresh the place in 10 years. I know for a fact that anyone else would have had to pay a more realistic $3600 figure so that’s the number I ran with. I also had to go in and tweak all the other assumptions, including the ones under the advanced settings button. This allowed me to factor in the monthly assessments, closing costs on both the purchase and ultimate sale, insurance, mortgage rate, property taxes, and maintenance and renovation costs.

The end result was a bit surprising because buying was not the slam dunk that I thought it would be – and it wasn’t until I assumed a 7 year ARM at 2.875% that buying broke even with renting after only 5 years. Oh…and I also had to assume that the buyer of this condo was smart enough to use a full service, discount real estate broker that would share their commission on the purchase and discount the commission on the eventual sale of the townhome. That also made a significant difference.

Of course the New York Times calculator does not take into account all the qualitative factors such as the flexibility afforded by renting vs. the stability and freedom to do what you want that comes with owning, coupled with all the headaches that you transfer to your landlord when you rent.

Suffice to say that it’s complicated and every situation is different. That’s why I recommend that people take the time to really think through their assumptions and work with that calculator. Just going through the exercise will help you think more clearly and rationally about the buying decision.