A bit over a year ago I wrote about how the history of the stock brokerage business could provide a lot of insight into the future of the real estate industry. It turns out that there are other areas of the investment business that also provide insight to what is in store for real estate agents. Just a few days ago BlackRock, one of the biggest investment management firms, announced that they were going to axe over 40 employees, including seven overpaid portfolio managers, and put a stronger emphasis on computer managed portfolios. Let me connect the dots to real estate for you.

When I was in business school more than 30 years ago (I guess I’m carbon dating myself) my finance professors made it clear that on average portfolio managers and analysts added no value. You could do just as well in index funds (passively managed funds) and at a lower cost. The academic research on the topic was clear cut on this. Yet investors continued to overpay for the services of these charlatans for several decades because everyone wants desperately to believe that using the right person is going to get them a better deal. (see the parallels?)

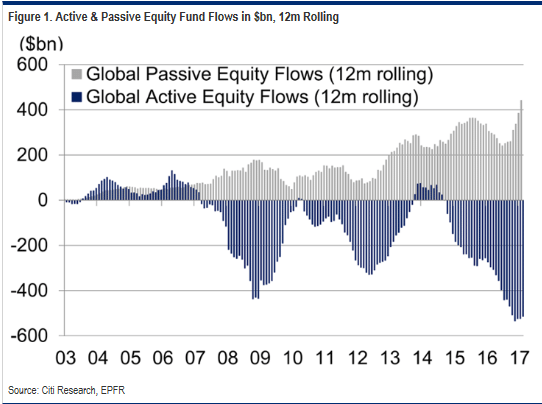

However, over time more and more people have gradually switched to index funds and it’s finally reaching a tipping point. Just look at this graph of funds flows between actively and passively managed funds over the last few years.

There are strong parallels with the real estate industry. For the longest time, and to this day, many realtors made bold and unsubstantiated claims about what they could do for clients in an effort to justify high commissions, often touting a variety of bogus performance statistics. However, over the last few decades technology has eaten away at any small advantage these realtors might have had, putting information directly into the hands of consumers. Yet, we are only recently seeing lower commission alternatives chipping away at the stranglehold that these realtors have maintained on their client base with a few savvy home buyers and sellers jumping to lower cost alternatives.

As with the investment management business, in this environment bogus performance statistics no longer matter as the consumer becomes more educated. What does matter is cost and service, attributes that are easy to measure.

#RealEstateIndustry #RealEstateAgents #Realtors

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service discount real estate brokerage. If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think he’s the next Kurt Vonnegut you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.