The Federal Reserve starts their Open Market Committee meeting tomorrow and the futures markets are basically giving an interest rate hike a 79% probability (as of last night). So, “interest rates” are going up and that means mortgage rates are going up and that means people will have to buy cheaper houses and that means that home prices are going to go crashing down. Woe is me.

Not so fast. First of all the interest rate that people are talking about here is the federal funds rate, which is the rate at which banks lend excess reserves at the Federal Reserve to each other overnight. The Fed is not raising “mortgage rates”. However, most people are lumping all interest rates together and assuming that a rise in the federal funds rate is going to cause mortgage rates to go up also. But the federal funds market is actually not very big – like maybe $60B – so who cares?

Well, there might be an indirect relationship. It turns out that short term interest rates – e.g. the 6 month treasury bill rate – are indeed affected by the fed funds rate. In fact, there is a .99 correlation between the two and if you follow that link I just left you they explain why. And short term interest rates affect long term interest rates, which affects mortgage rates. However, the correlation between the federal funds rate and the 10 year treasury rate is only .73, which is still significant but they’re clearly not tied together.

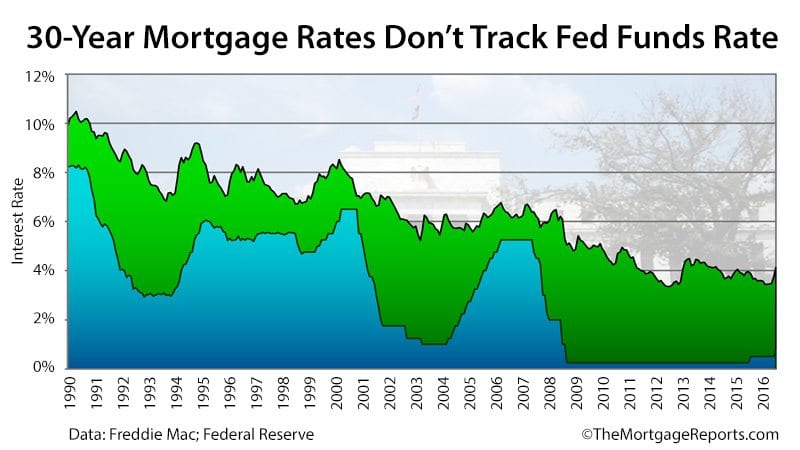

I wasn’t able to find the correlation between mortgage rates and the federal funds rate, though if I spent enough time looking for it I have to believe I’d eventually find it. However, I did find this great graph that compares the two rates going back to 1990 in The Mortgage Reports.

I think it’s pretty clear that the two rates do not move together. And frankly, I don’t think it’s the fed funds rate that matters so much anyway as does the open market operations of the Federal Reserve. That’s when they actually go out and move the market by buying or selling boatloads of fixed income instruments.

Until I hear about the Federal Reserve selling their mortgage backed securities I’m not going to hold my breath for rising mortgage rates. I’ll believe it when I see it.

#FederalReserve #Mortgages #MortgageRates

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service discount real estate brokerage. If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think he’s the next Kurt Vonnegut you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.