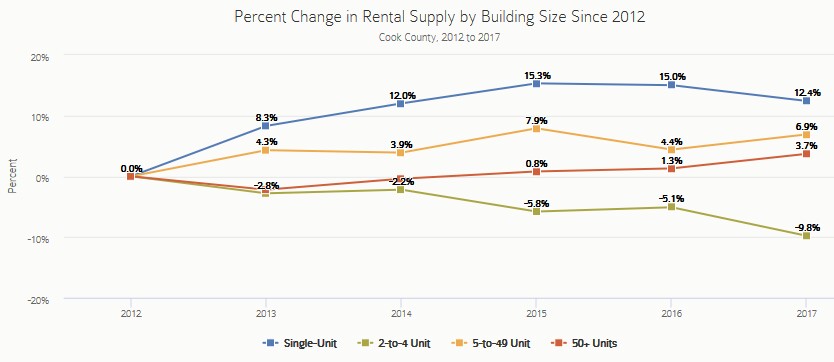

Back in late April the DePaul Institute For Housing Studies (these guys produce great housing data) produced a report on The State Of Rental Housing In Cook County which showed a fairly significant decline in the number of rental units available in Cook County in 2-4 flat buildings. The county (mostly Chicago, right?) has lost 29,212 units in these buildings since 2012, which translates to a 9.8% decline as shown in the graph below. Obviously they have been replaced by other types of rental units but the IHS laments this loss as “significant for housing affordability— these units are a valuable source of affordable rental housing and are being lost to deterioration, vacancy, and demolition in weaker markets and through conversion to single-family homes in stronger markets.”

North Center was one of the areas with the largest loss of affordable housing units in the last few years according to the study. At a forum sponsored by the Northcenter Neighborhood Association in late May Sarah Duda from the IHS attributed that loss at least partly to the loss of 2-4 flat buildings in the area, driven partly by the economics of replacing/ converting those buildings to single family homes:

The conversion of two- to four-flats to single-family homes is driven largely by the increasing value of those homes over the last 15 years, according to Duda. She noted that there’s been a divergence between property types in recent years; the median sales price of about $600,000 for a single-family home was about the same as a two- to four-flat building up until 2004, when single-family homes began to outprice their multi-unit counterparts. Today, single-family homes have an average median sales price of about $1 million in the area, while two- to four-flats have remained at about $600,000.

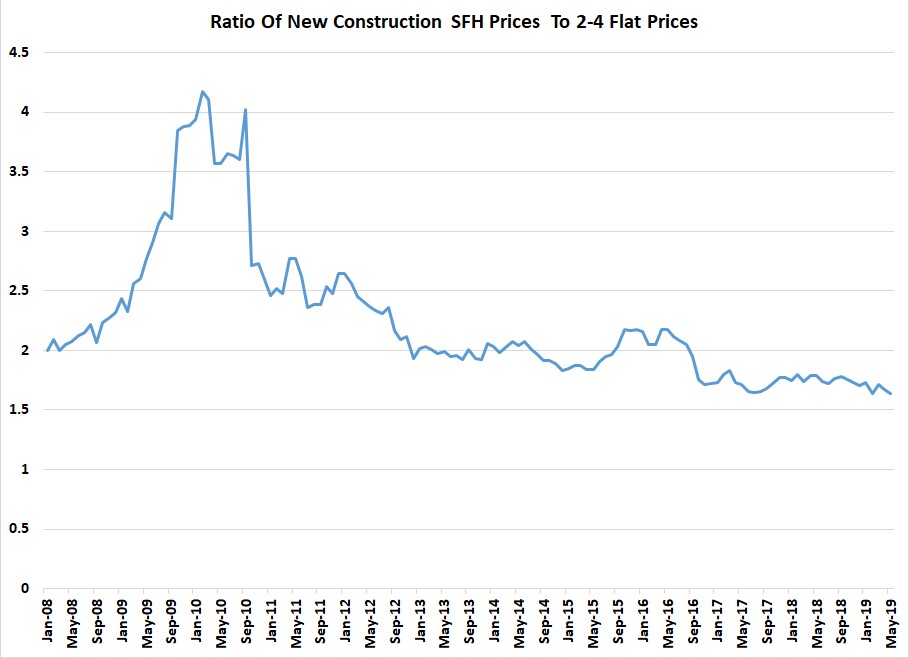

That got me to thinking so I took a look at the data. Unfortunately, I only have access to data going back to 2008 – about 10 years worth. However, looking at that data I didn’t see much of a trend in the ratio of single family home prices to 2-4 flat prices over that time period. It fluctuated between 1.44 – 1.85x. It then occurred to me that it was probably better to look at prices relative to new construction single family home prices instead, since that would better represent the economic driving force in the area. I did find more of a trend that way, with the ratio rising to 2.7x in mid 2010 and then gradually falling to around 1.9x in late 2017. It’s gone up since.

But I actually found that result too boring to bother you with a graph so I took a look at West Town. I know that plenty of 2-4 flats have been getting torn down in the area since 2012, which is when I moved into the area and became a magnet for other cool people to follow me. Sure enough the pattern was pretty interesting. Check out the graph below where I look at the ratio of the 12 month rolling averages (to smooth out the monthly gyrations) of average sales prices of the two types of housing.

Looking at this data and comparing it to the number of new single family homes being built over time I’ve concluded that the narrative is a bit more nuanced than the one articulated by IHS. Sure, when 2-4 flats are cheap relative to new construction homes there will definitely be an incentive to convert them or tear them down but why do they become relatively cheap or expensive in the first place? Because there is a demand side to the equation as well and during the 2009 – 2010 time period in the graph above when new construction prices temporarily skyrocketed there wasn’t that much new construction going on and the pricing anomaly did not result in a rash of new construction either.

I don’t know what was happening in the market at that time but apparently all the players knew that prices weren’t going to stay like that for long and they didn’t. New construction activity remained low while prices drifted lower and it wasn’t until prices drifted back up that activity picked up. And activity continued to rise even though 2-4 flats were becoming more and more expensive relative to new single family home construction. So, although the relative value of 2-4 flats is a factor in their being replaced by more valuable housing, it’s not the only factor. And, although their pricing can drive their conversion, the conversions also drive the pricing.

BTW, if you read that Chicago Agent Magazine article about the North Center forum that I linked to above you’ll see there’s a common theme throughout it of social engineers banging their heads against the wall trying to figure out how to fight the laws of economics – e.g. zoning, building code changes, affordable housing requirements, and vouchers. Good luck with all those.

#NewConstruction #Rentals #AffordableHousing #ChicagoRealEstate

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service real estate brokerage that offers home buyer rebates and discount commissions. If you want to keep up to date on the Chicago real estate market or get an insider’s view of the seamy underbelly of the real estate industry you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.