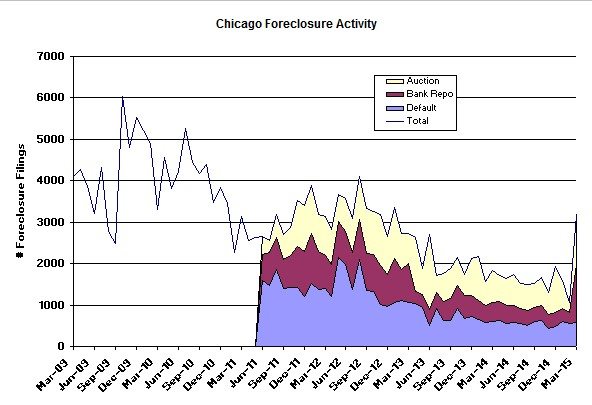

I did a double take yesterday when RealtyTrac released their March Foreclosure Market Report, including data for Chicago. Since peaking again in August 2012 Chicago foreclosure activity has generally been on a downward trend and actually hit a new low in February. Then the March data comes along and it’s roughly triple what it was in February. In fact, it hasn’t been this high since January 2013.

So I contacted RealtyTrac to see if maybe there was a data problem. I ended up talking to Daren Blomquist, who is the Vice President usually quoted in their monthly releases (more on that conversation later). They are confirming the Chicago data but it didn’t sound like there was a data problem. In fact, their on-the-ground intelligence indicates that the spike might have been the result of some kind of backlog that just cleared and released a flurry of activity.

Note that the surge in the graph below is in the two latter stages of foreclosure – bank repossessions and scheduled auctions. Defaults did not increase so the pipeline is not getting fatter and will probably end up clearing faster now. So if this data is correct then we can look forward to a surge in distressed properties hitting the market and a further reduction in the shadow inventory (see next section below).

The national data also showed a jump in foreclosure activity in March but nothing like what happened in Chicago. It was only up 20% from February but it did hit a 17 month high. Daren Blomquist commented:

The March increase is continued cleanup of distress still lingering from the previous housing crisis; not the beginning of a new crisis by any means. Some of the most stubborn foreclosure cases are finally being flushed out of the foreclosure pipeline, and we would expect to see more noise in the numbers over the next few months as national foreclosure activity makes its way back to more stable patterns by the end of this year.

Chicago Shadow Inventory

Chicago’s shadow inventory is not showing any signs of this expected flushing of the system just yet. In fact for the first time since I’ve been tracking this data the shadow inventory actually went up a tad in March. Stay tuned to see if there is a dramatic decline in this number on the horizon.

As I mentioned above I spoke with Daren about what might be going on with foreclosures in Chicago and one of the more interesting points he made was that back in early 2013 Illinois passed SB 16, otherwise known as the

So we are ending up with all these low end homes where the owner is in default on their mortgage, the bank is entitled to all the proceeds of any sale, but the bank doesn’t foreclose on the home. The owner can live there for free but they have little incentive to properly maintain the home and if they need to move they might just abandon the home. These homes become zombie foreclosures and it’s a growing problem for cities like Chicago.

#realestate #chicagorealestate #foreclosures

If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think I’m the next Kurt Vonnegut you can Subscribe to Getting Real by Email. Please be sure to verify your email address when you receive the verification notice.