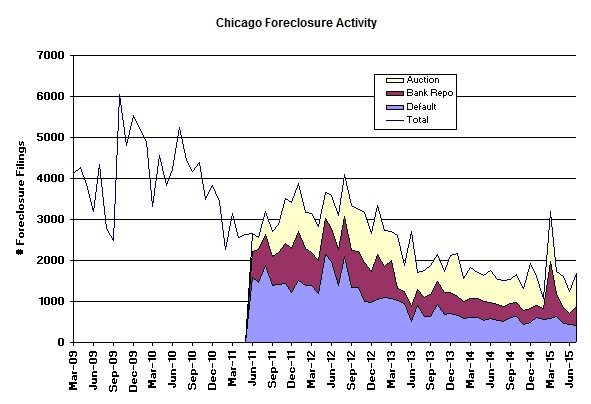

As I’ve pointed out before Chicago foreclosure activity is highly variable from month to month and July was no exception. The RealtyTrac July Foreclosure Market Report just came out and the Chicago data shows another increase but you have to look at the numbers in the context of the overall long term trend in the graph below.

You’ll see that the real variability comes from bank repossessions and especially from the auction activity – the two links in the chain that are driven more by bureaucratic endeavors as opposed to market forces. Defaults on the other hand are much more steady and on a regular path of decline. In fact, for July defaults hit a new low since I’ve been tracking the data.

With a decline in defaults, the surge in bank repossessions and auction activity is actually a good thing as it helps clear out the pipeline of properties in foreclosure limbo. Daren Blomquist, vice president at RealtyTrac, noted this in his comments on the national picture:

The increase in overall foreclosure activity over the last five months has been driven primarily by rapidly rising bank repossessions, which in July reached the highest level since January 2013. Meanwhile foreclosure starts in July were at the lowest level since November 2005 — a nearly 10-year low that demonstrates the recent rise in bank repossessions represents banks flushing out old distress rather than new distress being pushed into the pipeline.

This clearing of old distress is evident in the fact that properties foreclosed in the second quarter had been in the foreclosure process an average of 629 days, the longest in any quarter since we began tracking in the first quarter of 2007. It’s also evident that the recent surge in REOs is in fact clearing out more of the bad bubble-era loans from the so-called shadow inventory. RealtyTrac data now shows 61 percent of loans still in the foreclosure process were originated during the housing bubble years of 2004 to 2008, down from 68 percent last year and 75 percent two years ago.

In an accompanying video Daren emphasized my exact point above about the increase in foreclosure activity being a good thing in light of the fact that defaults are on the decline. In addition, he pointed out that these repossessions are helping provide much needed inventory for hungry buyers.

Chicago Shadow Inventory

So you would think in light of this that Chicago’s shadow inventory would have declined in July. Well, it really didn’t. It barely nudged down and I have no idea why. It will be interesting to see next month if some kind of log jam breaks and this metric takes a corrective dip.

#realestate #chicagorealestate #foreclosures

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service discount real estate brokerage. If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think he’s the next Kurt Vonnegut you can Subscribe to Getting Real by Email. Please be sure to verify your email address when you receive the verification notice.