RealtyTrac’s release of their March foreclosure market report on Thursday sneaked past me as it came out earlier than I was expecting and while I was focusing on my income taxes (what a needlessly complicated waste of time and now I have to suffer the further indignity of standing in line at the post office). There is so much variation in these numbers from one month to the next that it doesn’t really look to me like there is any particular change in the longer term trend for Chicago’s foreclosure activity.

All 3 components of foreclosure activity were up for Chicago, but most notably the auction component – up almost 36% from February.

At the national level RealtyTrac notes that March hit an 80 month low in repossessions and it was the 42nd consecutive month of lower year over year foreclosure activity.

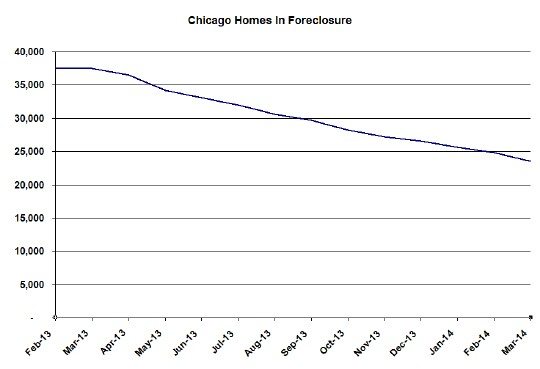

Chicago Shadow Inventory

Higher auction activity is actually a good thing for the market because it signifies the beginning of the end of foreclosure process. Everyone always wrings their hands about the shadow inventory lurking in the background of the market. The good news is that for more than a year now (how long I’ve been tracking this data) the number of homes that are in the foreclosure process in Chicago has been steadily declining – like in a straight line.

Daren Blomquist, vice president at RealtyTrac, is optimistic that the banks will now be able to really start focusing on this shadow inventory.

Now that the foreclosure deluge has dried up, banks are turning their attention back to properties that have been sitting in foreclosure limbo for some time. This is most evident in judicial foreclosure states that were more likely to have impediments in the foreclosure process, but there are also signs of this catch-up trend happening in some non-judicial states…

Banks will also now be able to devote more resources to dealing with the lingering inventory of nearly half a million already-foreclosed homes that still need to be sold. Our estimates indicate only 10 percent of these bank-owned properties are listed for sale and more than half are still occupied by the former homeowner or tenant.

The most interesting statistic revealed in this month’s foreclosure market report though is that it’s actually taking longer for the banks to sell the properties they own: “Properties sold in the first quarter had been bank-owned for an average of 226 days when they sold, up 34 percent from the average of 168 days in the first quarter of 2013.” RealtyTrac goes on to show this striking graph of the average time to sell foreclosures. However, please note that this graph measures the time from when the foreclosure process begins so it unfortunately includes the foreclosure processing time, which has also been increasing.

My theory is, and there is clear evidence of this in the Chicago market, that the banks are being much more aggressive in the prices they are trying to get for these foreclosed properties so it’s going to take longer for them to sell.

If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think I’m the next Kurt Vonnegut you can Subscribe to Getting Real by Email. Please be sure to verify your email address when you receive the verification notice.