If my previous post was real estate investing 101 (where I explored various metrics used to evaluate investment opportunities) then this must be real estate investing 102 since I’m looking at a more comprehensive evaluation model that incorporates many of those (only the good ones) same ideas.

Let’s start with a comprehensive list of factors to consider in a rigorous economic analysis of a potential investment property. Ideally an investor would make assumptions for each of these line items in evaluating an investment property.

- Purchase price + closing costs

- Needed improvements to property

- Property taxes

- Down payment

- Interest expense

- Vacancy rate

- Maintenance costs (should include reserves for big sporadic needs like a new roof or kitchen upgrades)

- Insurance

- Landlord paid utilities

- Total building rent

- Inflation rate

- Management fees

- Income tax benefits from depreciation

- Recapture of depreciation upon sale of building

The investor would then put together several years of projections based upon these assumptions and these projections would include the following results:

- After tax cash flow

- Return on equity

- Return on assets

You might also calculate simple metrics like Gross Rent Multiplier just so you can look for correlations between those simple metrics and the more sophisticated ones that really matter.

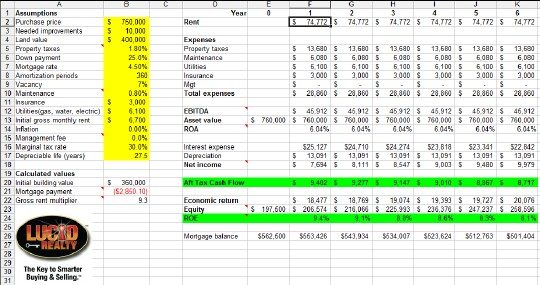

In order to facilitate this analysis I created a spreadsheet for our more sophisticated investors to use in preparing these projections. And the lack of legibility is intentional. I don’t want to facilitate reverse engineering.

The yellow cells are where the assumptions go and the green rows show the more important results. One of the points that this spreadsheet highlights is that the results vary over time. For instance, return on equity goes down as equity builds and so does after tax cash flow as the interest deduction diminishes. That’s why investors need to periodically evaluate refinancing or selling their properties. If a new property can provide better results than an existing property it’s time to make a change.

The next time I look at real estate investing (I guess it will be real estate investing 103) I will look at the effects of mortgage rates, inflation, and leverage on investment results.

#realestate #realestateinvestments #realestateinvesting

If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think I’m the next Kurt Vonnegut you can Subscribe to Getting Real by Email. Please be sure to verify your email address when you receive the verification notice.