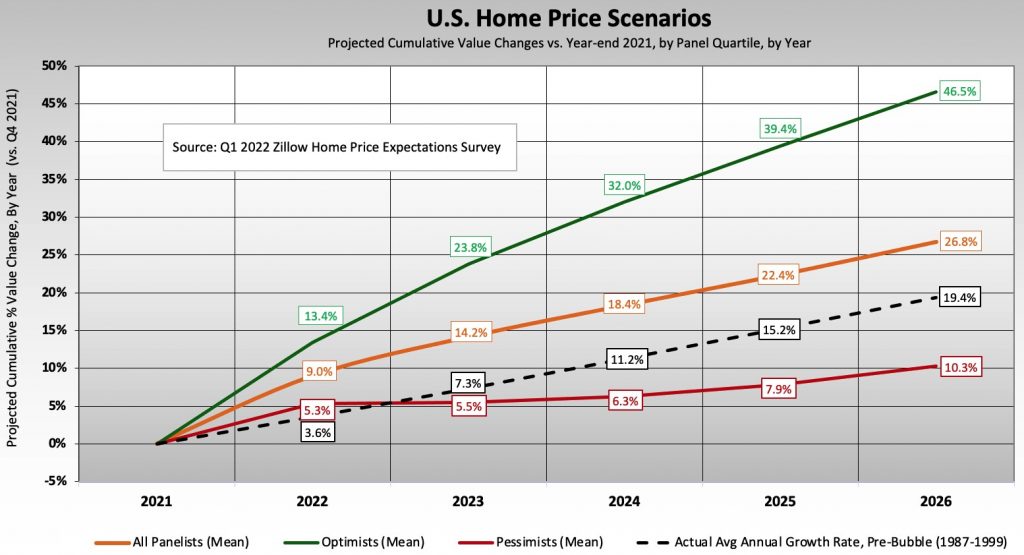

I just covered the most recent Case Shiller home price indices release that tells you were home prices have been going so now is a good time to give you an idea of where home prices are believed to be heading. A couple of weeks ago Zillow and Pulsenomics conducted their Q1 2022 Home Price Expectations Survey of 109 housing market experts. Since 2020 drops off their radar for the first quarter survey, I calculated that their forecast for 2022 home price appreciation was 6.5% last quarter but it’s now 9.0% in this quarter’s survey. Their 5 year outlook went from 23.4% cumulative appreciation to 26.8%, which annualizes to 4.9% compounded. You should take note that that much appreciation basically covers a 4.9% mortgage rate…but it doesn’t help your cashflow in the interim. The 5 year compounded rate was 4.3% last quarter.

Pulsenomics founder Terry Loebs commented on the drivers and consequences of the more bullish outlook:

Against the backdrop of tightening Fed policy and increasing mortgage rates, this more bullish outlook for home values suggests that home inventory shortages will remain the dominant price driver this year. If price increases this year for homes, rents, energy, and food each exceed wage growth – as the panel expects – home affordability challenges will intensify further, especially for low- and moderate-income renters.

Since exceptionally low home inventory is driving prices the respondents were also asked about when they expected this “problem” to be resolved. Almost none of them thought it would happen this year and many thought it would not happen until 2024. Of course the other big wild card in all of this is what rapidly rising mortgage rates might do to demand. If you’ve been following interest rates you know that they have really skyrocketed recently and that could cause the rapid retreat of buyers from the market.

Chicago Area Home Price Outlook

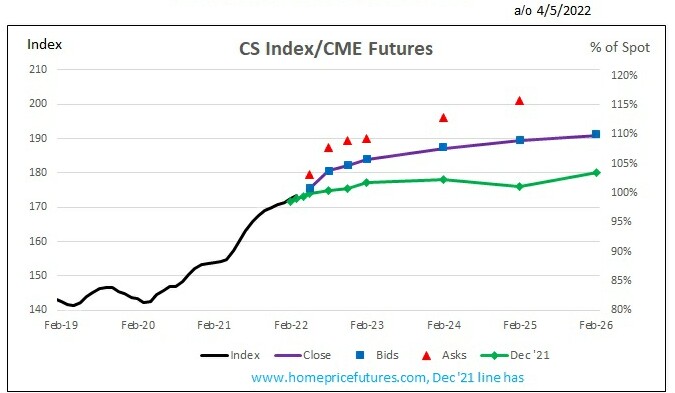

Once again I’ve turned to the Case Shiller home price futures market for insight into the outlook for Chicago area home prices. John Dolan, who happens to be one of the panelists contributing to the home price expectations survey and who is also the market maker for the Case Shiller home price futures, provided me with the data and graph below.

From the end of 2021 to the end of 2024 the futures are implying cumulative price increases of 13.3% or 4.2% annualized and compounded. That compares to the national forecast of 18.4% over the same time period.

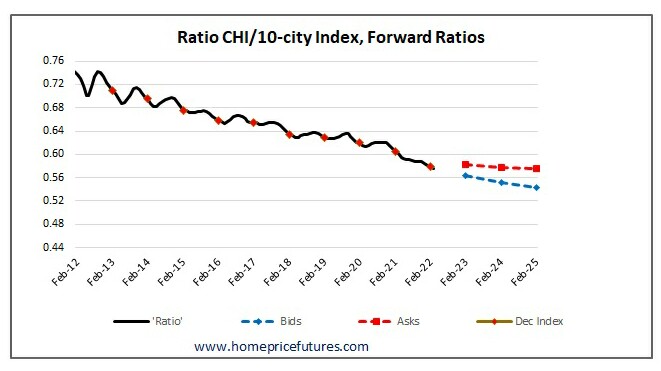

John Dolan has also been following this sad story of Chicago’s lagging home prices so he produced this supplemental analysis which looks at the ratio of Chicago home prices to Case Shiller’s 10 city average both historically and projected based on the futures prices. As you can see that ratio has been going straight downhill and the futures prices project a continuation of this trend, albeit at a slower rate. You would think that Chicago could put a positive spin on this and market our greater housing affordability in attracting businesses to the area.

#RealEstate #ChicagoRealEstate #HomePrices

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service real estate brokerage that offers home buyer rebates and discount commissions. If you want to keep up to date on the Chicago real estate market or get an insider’s view of the seamy underbelly of the real estate industry you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.