This is a guest post written by Chad Rothrock, Director of Operations at Kensington Research & Recovery, which consults with homeowners and businesses on appealing their property tax assessments to reduce future property tax payments.

For Cook County homeowners, property tax news is almost never good news: taxes are going up. The system is rigged in favor of the wealthy and well connected. The appeals process is ridiculously complicated.

And the math… who wants to go there?

But if you’re letting the fog of acronyms, hazy adjectives (effective tax rate, equalization factor, triennial reassessment?) and percentage points hold you back from joining the tens of thousands of Cook County property owners who successfully appeal their tax assessments year after year, the news is even worse.

Here is one place where the math is easy: those who don’t appeal pay for the reductions won by those who do.

It’s a system that leaves many homeowners feeling like they can’t win, no matter what they do. When it takes a team of top investigative reporters months to unravel the process, it’s easy to understand why so many property owners become discouraged or are taken in by misconceptions surrounding the way property taxes work – and don’t work – in Cook County.

Here are just a few of the misconceptions of Cook County homeowners that cost them hundreds or thousands every year:

Misconception #1:

I already won a property tax reduction. Why do it again?

While you should always appeal your property tax assessment following the reassessment of your home every three years, the housing market is fluid in terms of recent sales and the Chicago Tribune investigation linked above shows plenty of evidence that Cook County fails to keep up with it.

If you don’t appeal every year, or at least review your assessment against the current market, there’s a significant possibility that you are leaving a lot of money on the table.

Misconception #2:

The system is rigged against me, so why bother?

The system is “rigged” against people who don’t appeal. The tax assessor’s office has repeatedly acknowledged that it relies upon the appeals process to ensure that properties are assessed fairly because their initial assessment is often wrong.

Misconception #3:

The process is too complicated and time consuming.

The process is complicated. Making an argument to reduce your tax assessment requires a deep dive into the tax assessments of comparable properties and market transactions.

But you don’t have to do it alone. You can hire third-party experts who have made a science of keeping up with and obtaining all of the county’s data and extracting the right “comps” to make a winning argument, and you typically don’t pay unless you win.

Misconception #4:

Why appeal before reassessment? My property taxes are going to go up anyway.

Some Cook County property owners think that, while they may save thousands from an appeal, the savings will be wiped out once their home is reassessed, so why bother?

This misconception may cost the most amount of money for Cook County homeowners who do not appeal.

First: appealing before your home is reassessed could save you hundreds or thousands when your next bill comes due. If you pay a third-party a percentage of the savings, you are still getting the remainder.

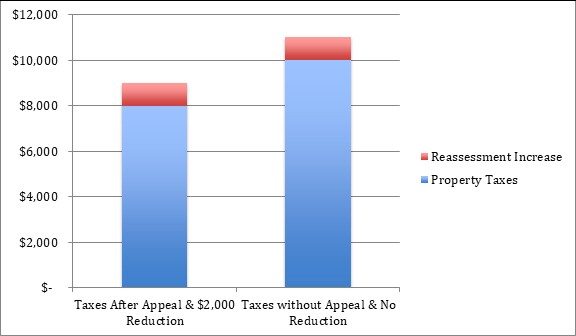

Second: The Cook County Assessor’s use of ratio studies to reassess properties means that if you do not appeal prior to the triennial reassessment, the percentage increase applied to your property will be applied to an inflated assessment rather than the reduced assessment obtained in an appeal. See the graph below:

Bottom line: if your home’s assessed value increases, do you want to pay the increase on a reduced property tax assessment or on a higher, non-appealed assessment?

Still Not Sure? Request a Property Tax Reduction Estimate

We recommend that you request a property tax reduction estimate from an experienced third-party consultant to see how much you could save before making any decisions. Then you can decide if appealing your property taxes works for you, how much you could save and whether to use a partner or not.

#PropertyTaxes #PropertyTaxAppeal #CookCountyPropertyTaxes

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service discount real estate brokerage. If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think he’s the next Kurt Vonnegut you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.