A few days ago Dennis Rodkin wrote a story in Crain’s about how Downtown has huge oversupply of homes for sale. The suggestion from some of the realtors interviewed for the story is that the triple whammy of Covid-19, taxes, and now looting is motivating people to move out of Downtown Chicago. I’ve actually been meaning to look into the data for some time now but was waiting for the August data to come in. It’s still a bit early in the month to look at the data but now that the Crain’s story is out I thought I would weigh in sooner rather than later.

So I poked around in the data a bit and, indeed, something might be amiss. I don’t want to inundate you with too many graphs so I’ll just tell you what I found in a quick glance at the data. Two community areas are not like the others: The Loop and the Near North Side. The months of supply of condo inventory (I excluded single family homes so that my neighborhood comparisons weren’t thrown off by different housing mixes) is way up over last year as calculated in the canned programs available to us. You also see this to a much lesser extent in the adjacent community areas of the Near West Side and Near South Side.

However, 2020 is not a normal year and the market got shifted out a couple of months. In other words, people started listing their homes later in the year than they normally would and the buyers also came out later. For instance, August new listings were up 97.4% in the Loop and 94.3% in the Near North side vs. last year. However, on a rolling 12 month basis they are pretty much in line with where they were going before Covid struck. Contract activity was down 32.5% in the Loop but flat in the Near North Side vs. last year. On a rolling 12 month basis they were also substantially down but, again, it appears to fit right in with a long term trend.

Given that the market is in a huge state of flux, I’ve been temporarily doing my own calculation of months of supply of inventory based upon homes available for sale in each month and contracts written in those same months to give us a better sense of what is going on right now. The conclusion may be the same but this calculation provides a bit more context.

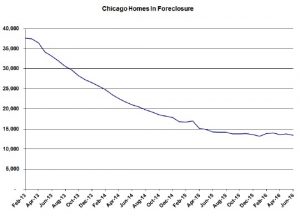

In the graph below I’ve plotted my months of supply numbers going back to 2008. I put the vertical lines at all the Augusts so that you could more easily compare changes from one year to the next. It’s true that the months of supply in these two community areas just hit their highest August level since 2010 but the increase doesn’t look anywhere near as dramatic with my numbers as it did with the canned reports. Also, note that April was a bit higher but that was a temporary condition brought about by contract activity stopping dead in its tracks.

In August the Loop jumped to an 12.2 month supply while the Near North Side jumped up to 11.8 months. While these are pretty big increases notice in the graph how there has been an upward trend over the last 3 – 4 years. Consistent with that observation, market times have been drifting upwards over the same time period. So it appears that something has been underway for a while and it may not all be driven by recent events. Downtown is just no longer the place Petula Clark sang about.

#UrbanFlight #DowntownChicago #ChicagoLoop #ChicagoGoldCoast

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service real estate brokerage that offers home buyer rebates and discount commissions. If you want to keep up to date on the Chicago real estate market or get an insider’s view of the seamy underbelly of the real estate industry you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.