Some people who want to sell their homes often decide to hold off on the hopes that home prices are going to “come back” soon. Implicit in this decision is the assumption that when home prices do come back they are going to come roaring back – i.e. they’ve dropped 29% so a big double digit pop is coming. I always tell them that the safest assumption is that prices will rise at the rate they did prior to the bubble – 3.7% per year (for Chicago). Just because something was once priced high doesn’t mean it’s going to be priced that high again any time soon. A great example is the NASDAQ market which peaked around 5048 in March of 2000. Today it is sitting at 2254. It didn’t come roaring back.

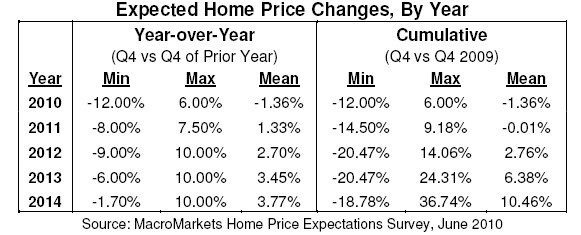

But you should take anything a realtor tells you about future home prices with a very large grain of salt. However, there are more objective prognosticators out there that are worth listening to. As I’ve mentioned before the MacroMarkets folks have a lot of credibility in my mind and every month they release their Home Price Expectations Survey based upon the Case Shiller home price index (seen to the left). Their most recent survey, released today, represents the composite forecasts of a diverse group of 106 “economists, real estate experts, investment and market strategists.” This survey looks out over the next 5 years and comes up with an average annual composite appreciation of about 2%. Of course, that’s at a national level but it’s in the ballpark of my 3.7% rate for Chicago. Here are the MacroMarkets home price forecasts broken out in more detail from their press release: