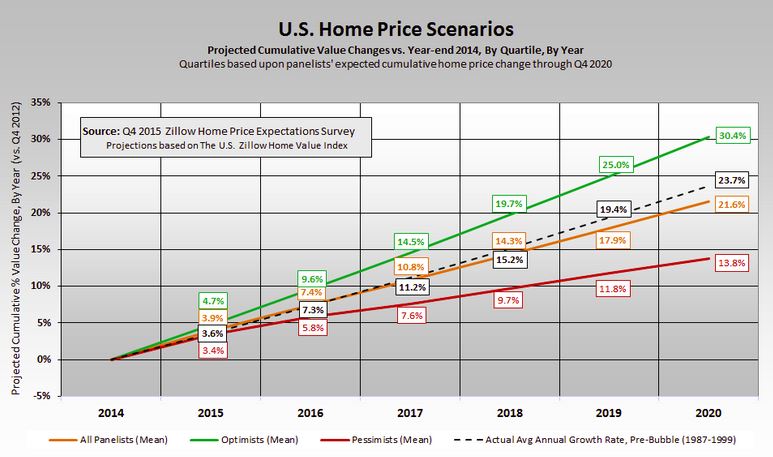

Once again the housing experts have pontificated on their national home price forecast for the next 5 years and once again they have throttled back their optimism…very slightly. The 4th quarter 2015 Home Price Expectations Survey released by Zillow/ Pulsenomics last week shows a consensus forecast of 17.9% cumulative appreciation from 2014 to 2019 vs. 18.1% last quarter. That works out to a little more than 3.3% per year compounded, which actually “pays for” the after tax interest cost on most mortgages.

The experts also dialed back their outlook for 2015 to 3.9% from last quarter’s 4.1%. The graph below lays out the survey results in detail.

Here is how Pulsenomics Founder Terry Loebs summarized the survey results:

The long-term outlook for U.S. home values has diminished to a three-year low, and a clear-cut consensus among the experts remains elusive, even at the national level. Based on the projections of the most optimistic forecasters, home values nationally will increase 4.7 percent next year and surpass their May 2007 peak levels in April 2017. In contrast, the data collected from the panel’s most pessimistic respondents expect only 2.3 percent appreciation for next year, and even more subdued appreciation thereafter – a path that would delay the market’s eclipse of the bubble peak until September 2019.

Outlook For Chicago Area Home Prices

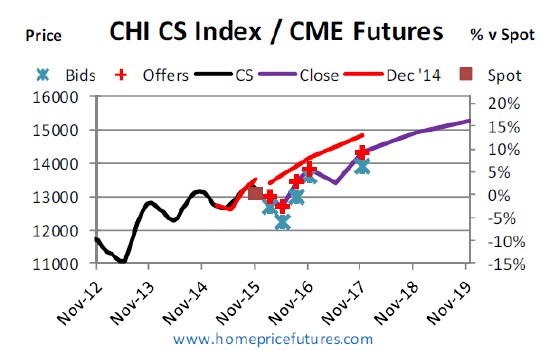

The closest thing to a home price forecast specific to Chicago is found by looking at the Case Shiller futures market, which is unfortunately very thinly traded. I pulled the graph below from John Dolan’s November 30 Case Shiller futures review.

The furthest out data point is still November 2017 (which reflects the release for September 2017) and unfortunately the outlook since I looked at this 3 months ago is down substantially. In my last update the market had the index at 150.2 but now it’s at 141.2. Relative to the September 2015 value that was recently released that works out to 3.2% appreciation per year, which is reasonable and in line with the national picture discussed above.

But What About All This Talk Of A Housing Bubble?

By now you’ve probably heard a lot of people talking about housing bubble 2.0, which makes for great cocktail chatter and helps fill in on slow news days. But how real is the threat and where is it? Fortunately, this quarter’s survey solicited the views of the oracles on this topic but you have to go to the press release or the complete report to see the results.

Almost 3/4 of the survey respondents believe that San Francisco is either already in a bubble or is likely to be in a bubble in the next five years. Next on the list would be Los Angeles and New York, followed by Boston. Chicago on the other hand is one of the least likely cities to be in a bubble over the next 5 years – only 12% of the respondents thought it would happen. Remember Chicago is lagging the major metro areas in home price appreciation. And the survey respondents tended to lean towards the belief that Chicago would continue to lag the rest of the country.

#HomePrices #RealEstate #ChicagoHomePrices

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service discount real estate brokerage. If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think he’s the next Kurt Vonnegut you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.