In case you forgot…you still don’t know what your 2014 Cook County property tax bill is yet. All you’ve paid thus far is a rough estimate of the first half of the bill for 2014 and you’re waiting for them to come up with your balance due based upon their calculation of your total bill for 2014. The bills will be mailed in July and, if last year is any indication, your second installment will be due on August 1.

However, last week the Cook County Clerk’s office released the 2014 property tax rates, which should allow you to estimate what your 2014 property tax bill is going to look like – if you know how to interpret the data. Let’s take a stab at this but first you might want to review a post I did a couple of years ago that included a section on how your property taxes are calculated: 2012 Cook County Property Taxes: What Just Happened To Chicago?

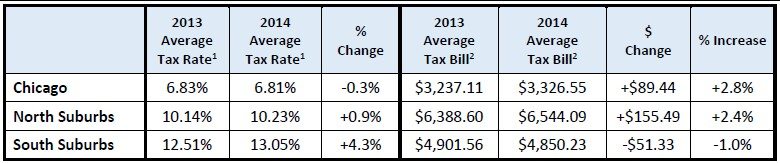

The two main factors in that calculation are what they just released – the Equalization Factor and the Tax Rate. According to the release the equalization factor has increased by 2.4% and the tax rate has…well it depends on where you live. Chicago is down 0.3%, the Northern Suburbs of Cook County are up 0.9% and the Southern Suburbs are up 4.3%, but if I’m not mistaken those suburban percentages are averages and each suburb actually has a different percentage change.

For Chicago, I take those two percentages, multiply them together, and I get a net change of +2.1% and that’s what I would tell you to expect – barring any changes in your overall assessed value. Just take last year’s tax bill and add 2.1% to it. However, the Clerk’s office put together this little summary table below (it’s clickable for a bigger version) that shows Chicago getting a 2.8% increase on average. I really don’t understand that but I’m speculating that it also reflects some change in the average value of properties.

So it doesn’t look like Armageddon has hit us yet but there’s always next year. Remember, 2015 is a reassessment year and you may find out that your home has appreciated by 50% – but good luck selling it for that price.

The end result of all these factors is that for 2014 your Chicago property taxes will be roughly 1.86% of what the county thinks the market value of your property is before factoring in the homeowner exemption. The homeowner exemption will save you about $477 in property taxes. And keep that 1.86% number in the back of your mind because when they come up with your new estimated market value in 2015 you can apply that percentage to estimate your 2015 taxes.

#PropertyTaxes #CookCountyPropertyTaxes

If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think I’m the next Kurt Vonnegut you can Subscribe to Getting Real by Email. Please be sure to verify your email address when you receive the verification notice.