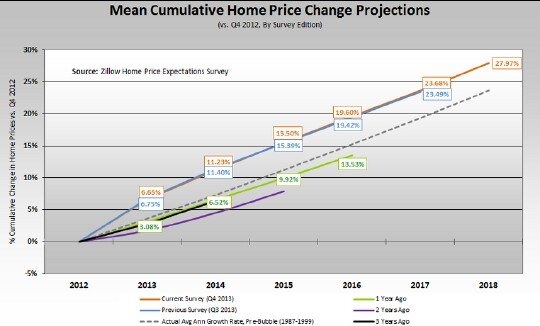

Pulsenomics just came out with their quarterly, Zillow sponsored five year home price expectations survey of a little more than 100 economists. This survey came out last week and it shows continued optimism for home price appreciation. The graph below sums up the current outlook and compares it to previous expectations. Note that this quarter’s survey extends the outlook into 2018 for the first time. The original and much larger graph is available at the link above.

The different colored lines represent the outlooks at different points in the past. They have been drifting upwards with each successive forecast and the orange line at the top is the most recent outlook. The numbers noted along the lines represent cumulative appreciation. The most recent forecast shows cumulative appreciation through 2018 of 28%, which is equivalent to a 3.7% compounded annual rate of appreciation over the next 5 years. When you consider that 30 year fixed rate mortgages are around 4.4% before the tax benefits this means that home price appreciation can significantly offset the interest cost on a mortgage over time. Nevertheless, the Chicago area would have to do a lot better than 3.7% per year in order to revisit the peak valuations before 2018.

The predictions do show some slowing down in the appreciation rate over the next few years. Zillow Chief Economist Dr. Stan Humphries commented that:

The housing market has seen a period of unsustainable, breakneck appreciation, and some cooling off is both welcome and expected. Rising mortgage rates, diminished investor demand and slowly rising inventory will all contribute to the slowdown of appreciation.

Outlook For Chicago Area Home Prices

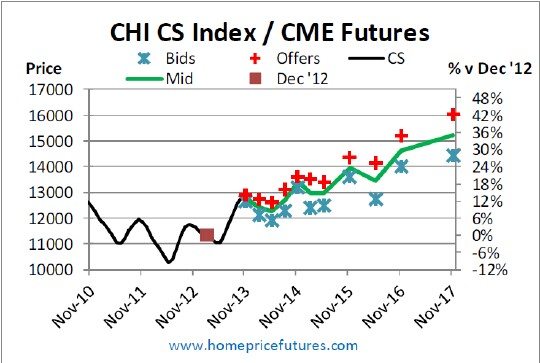

Although Pulsenomics doesn’t produce a survey of the Chicago area home price predictions we actually have something a bit better. We can look to the Case Shiller home price index futures market to see what people are putting their money on – and if you don’t agree with them you are free to put your money where your mouth is.

The graph below is courtesy of John Dolan’s October review of the Case Shiller Futures market. John is the market maker for the housing futures. What the graph shows is that the market is predicting about a 36% increase in Chicago area home prices from the December 2012 release to the November 2017 release. Looking at the underlying data it looks like this market is predicting annual returns of about 4.5% for the next 4 years.

Economists Weigh In On Government’s Role In The Mortgage Market

As part of the press release Pulsenomics points out that the government is currently backing 90% of all the mortgages in the country, up from around 50% prior to the bubble. Well, that can’t be good as it distorts the market. So as part of this survey they asked economists for their opinions on the appropriate role of government in the housing market:

- 58.4 percent said the federal government’s involvement in the conforming mortgage market should be “somewhat significant,” “significant” or “very significant.” I was really surprised that it was this high.

- 8 percent said the federal government should have a “non-existent” role in the conforming market.

- When asked what maximum percentage of all new mortgages should be backed by the federal government, the median response was 35%.

Personally, I don’t get why the government should subsidize the housing market – or for that matter any market.

If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think I’m the next Kurt Vonnegut you can Subscribe to Getting Real by Email. Please be sure to verify your email address when you receive the verification notice.