Yesterday RealtyTrac released their 2011 Year-End Foreclosure Report which included the December data. The big headline of this report is that there was a 34% drop in foreclosure activity last year and that foreclosure activity was at the lowest level since 2007. But when you read beyond the headline it doesn’t sound quite as good. Here are a few select quotes from their report, which focus on the foreclosure processing delays that we experienced in 2011.

The lack of clarity regarding many of the documentation and legal issues plaguing the foreclosure industry means that we are continuing to see a highly dysfunctional foreclosure process that is inefficiently dealing with delinquent mortgages — particularly in states with a judicial foreclosure process (Illinois is one).

There were strong signs in the second half of 2011 that lenders are finally beginning to push through some of the delayed foreclosures in select local markets. We expect that trend to continue this year, boosting foreclosure activity for 2012 higher than it was in 2011, though still below the peak of 2010.

Speaking of the foreclosure processing timeline…Illinois has the 4th worst in the nation at just under 600 days – about double what it was back in 2007 (when it comes to real estate problems Illinois makes the top of many lists). If you click on that link above you can actually see a really messy graph (too messy for even me to include) that shows you just how much the processing timeline has increased for some of the nation’s worst states. Anyway, if you stop paying your mortgage it looks like you have a good chance of living for free for close to 2 years before you get evicted (I am not giving out advice here).

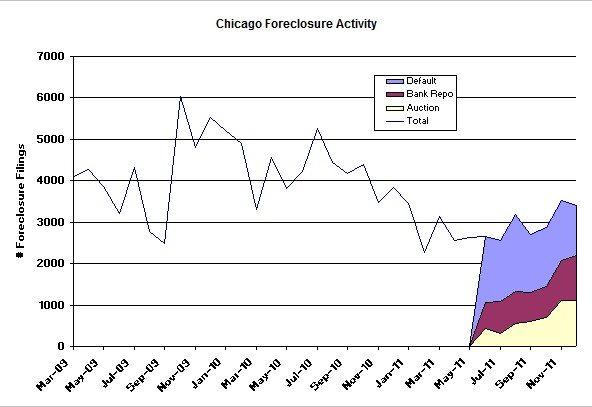

In other local foreclosure news…using RealtyTrac’s detailed Chicago data I am now keeping track of the different components of the foreclosure process in the graph below, which shows that in the last few months of 2011 there was an upward trend in foreclosure activity in Chicago. From the graph it looks like a lot of the subject properties have been moving through the pipeline into bank repossession and finally auction, which increased those activities. Meanwhile the default notices seem to be running at a relatively constant level.

If you are interested we maintain a page of on our Web site that contains this foreclosure data along with numerous other Chicago real estate market data all in one place.

If you look at your house as a business — or even an investment– and remove the emotion, it is very difficult to justify “keeping the doors open” (paying the mortgage), when a comparable house across the street, sold via a short sale or through foreclosure, has a value and a mortgage that is roughly two-thirds what your payments are.

Most homes will be sinking assets in most neighborhoods in Chicago for some time to come.

When will those current with their mortgages assess the situation and realize that they are being played for a fool and are subsidizing those who do not pay and losing money on the biggest purchase of their lives?

When will the critical mass of payers vs non-payers be reached, and what will that mean for the bank service companies and Freddie and Fannie and the economy?

A lot of people just can’t do a short sale or let their home go into foreclosure. Maybe they make too much money or have too much money to qualify for a short sale or they don’t want to hurt their credit rating with either a short sale or a foreclosure.