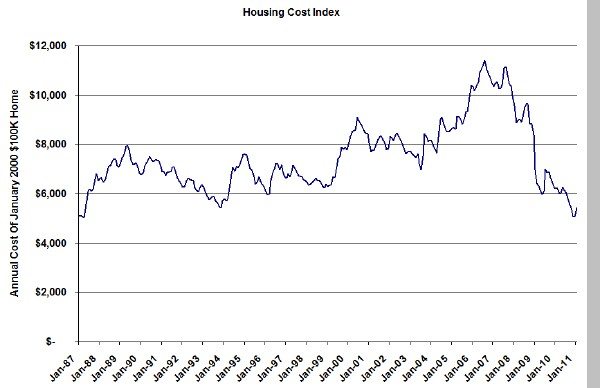

All the news stories and even this blog tend to focus on either home prices or mortgage rates. But in reality what we should be focusing on is the cost of owning a home, which combines the effect of both the price of a home and the cost of the mortgage on that home. So I decided to come up with my own crude estimation of the combined effect of these two factors to get a better idea of where housing costs are relative to historical levels. I started with the Case Shiller index and factored in the estimated annual interest cost for mortgages closed during each month in the time series. The graph below plots this estimated interest cost for a mythical home that cost $100,000 in January 2000.

As you can see from the graph we just bounced off an almost 23 year low in housing costs. Well…probably. In reality the Case Shiller home price index for Chicago is only available through November and even that data point really represents an average of September – November. However, we already know that mortgage rates have spiked up since then by 11.3%. So it’s unlikely that home prices will fall that much in just the next 2 months. For purposes of the graph above I very generously assumed that the Case Shiller index would decline another 2% in each of the next two months in order to demonstrate the impact of rising mortgage rates. You can see that in a very short period of time increases in mortgage rates can dwarf drops in home prices.

So where do housing costs go from here? Home prices are likely to decline a bit more – at least in the short run – but mortgage rates are almost certain to continue rising. And in my opinion mortgage rates have a lot more room to run up than home prices have room to go down. So there’s a really good chance that we are very close to the bottom in housing costs.

Note on my methodology: Housing costs in a given month are based upon the Case Shiller index for the subsequent month since the index represents a 3 month trailing average. Interest costs are based upon 100% of the price of the home in order to reflect the opportunity cost of any down payment. Mortgage points are assumed to be financed as part of the mortgage.

so where is that post about how if interest rates go down it offsets any savings by a drop in price for a home for sale?

I’m afraid I’m not following you. If mortgage rates go down it complements the savings from price drops.

sorry, meant to say “if interest rates go up” that will teach me to work and post at the same time

Well, you should stop working then.

That’s what this post is about in a round about way I guess. If you look at the far right part of the graph you can see how the cost of housing ticks up despite further drops in home prices. Mortgage rates have gone up over 11% in just a couple of months. No way home prices will drop that fast. And like I say in the post mortgage rates can go up a lot further than home prices can go down at this point.