Since last week’s post on the impact of the coronavirus on the Chicago real estate market was the first one this is by default week 2. Let me start with the latest data on contract activity and inventory – just got it yesterday – which goes through March 14. So it’s about a week behind and doesn’t reflect any impact from Pritzker’s stay at home order issued on Friday. However, a lot of people were already staying home before they were told to do so.

There were 294 detached homes put under contract, which is a 10.9% increase from last year. However, attached home contract activity actually declined by 9.1% to 418. So a bit of a mixed bag here. And the available inventory tells a similar story. Remember that normally at this time of the year inventory is rising. Instead we are seeing the number of homes on the market flat to slightly declining. Detached inventory dropped 9.5% to 2777 units while attached inventory dropped 0.9% to 4927.

So if you’re looking to buy right now there’s going to be less to choose from than last year. Frankly, we’re hearing that buyers are holding back and sellers – or their tenants – really don’t want people walking around their homes right now depositing coronavirus on everything.

One other thing to note…although real estate is considered an essential service under Pritzker’s stay at home policy the Chicago Association of Realtors has issued the following advice to realtors: “CAR recommends that its members and others in the real estate industry refrain from face-to-face real estate practices as much as practicable.” While this doesn’t necessarily kill the real estate business in Chicago it certainly makes it more difficult to show properties. The idea is that realtors can experiment with virtual tours of various sorts.

What The Data Tells Us About People Looking To buy

I turned to Google Trends to see what I could glean about home buyer interest by looking at two search terms: Chicago realtor and Chicago homes for sale. Here is the graph and the last data point is for the week ending March 21, so it’s a little more current than the contract activity data above.

It’s not totally conclusive because there is a ton of variability in the data but it sure seems to suggest that interest started to taper off in that week. Compare the last data point to the first data point on the graph.

The Stock Market Still Doesn’t Like The Real Estate Stocks

Last time I looked at Realogy, among others, and it is now down 78.4% from its peak. Last time I did not take a look at Remax but I’m here to tell you today that it is now down 49% from its peak. And, meanwhile, Zillow announced that they are going to slash their expenses by 25% in order to ride out the coronavirus mess.

Although Compass is not a publicly traded company, the free spending, Softbank backed company announced yesterday that they are laying off 15% of their staff – about 375 people. According to TheRealDeal:

With the economy reeling from the coronavirus pandemic, the Softbank-backed brokerage said it was projecting a 50 percent drop in revenue over the next six months.

“We aren’t just facing an economic recession, we are facing an economic standstill,” CEO Robert Reffkin wrote in an email to agents. “The best we can hope for is a V-shaped recovery as opposed to an extended recession.”

Keep in mind that Softbank is the same company that backed and got burned by WeWork so they are most likely keeping a tight leash on their portfolio companies these days. One of Compass’ main attractions for realtors is their support and technology so it remains to be seen what these cuts will do to agent retention.

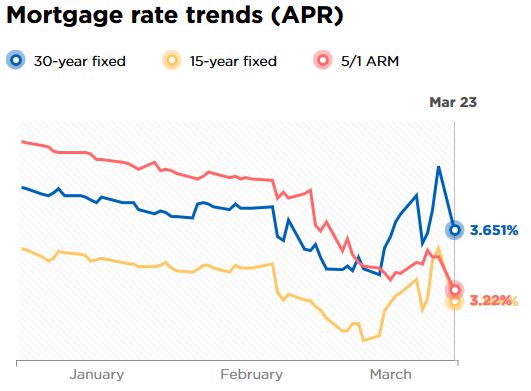

Mortgage Rates Are Not Helping

The mortgage rate graph below is once again from NerdWallet and it shows just how volatile rates have become over the last few weeks. They are well above their recent lows, with the exception of the 5/1 Arms, which may have hit new lows. But the other rates actually recently hit 3 month highs – not the lows the media might be promising you these days.

The iBuyer Model May Be Dead

The iBuyer Model May Be Dead

Last week I speculated that this whole catastrophe might be the end of the iBuyer business model and sure enough a series of announcements came out this week from most of the major players in this space. Zillow, Redfin, Realogy, and Opendoor all suspended their iBuyer programs yesterday because of the pandemic. Notice that they all “suspended” their programs which technically means that they could resurrect them once this whole thing (hopefully) passes. Then again they may just conclude that that business is too risky and this is a great way to exit the business without losing face.

#RealEstate #ChicagoRealEstate #Coronavirus

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service real estate brokerage that offers home buyer rebates and discount commissions. If you want to keep up to date on the Chicago real estate market or get an insider’s view of the seamy underbelly of the real estate industry you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.