When it comes to Cook County property taxes I am always amazed at how little Chicago realtors actually know about this topic. In fact, many real estate attorneys often don’t know as much as they should. Well, with last week’s release of the 2012 property tax rates for Chicago and the rest of Cook County by David Orr, Cook County Clerk, I decided it was time for me to attempt to demystify the subject and give you a preview of what you (if you live in Chicago) will probably find in your mailbox in a week or so when your get your property tax bill. I might even be able to shed some light on how to lower your property taxes. But this is going to take more than one blog post.

Understanding Chicago Property Taxes

First of all, just in case you missed it, you pay your Chicago property taxes in arrears – a year late basically – in two installments. That’s your first clue as to how convoluted this whole process is. Second of all, we need to get a common myth out of the way before we go much further. In your first installment for 2012 you did not pay half, you did not pay 55% of your 2012 tax bill. Until last week they really didn’t know what property taxes they were going to hit you with so they charged you 55% of your 2011 property taxes. Once they figure out your total property tax bill for 2012 they basically charge you the remainder in your second installment. This is your second clue as to how convoluted this whole process is.

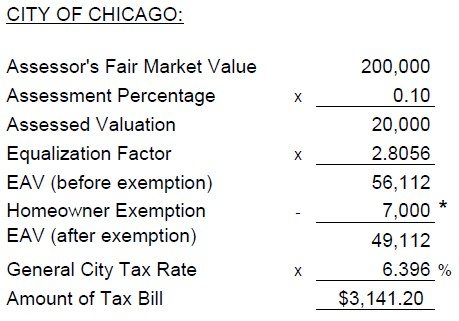

Now it gets really convoluted in a way that only the government can imagine. The Cook County Assessor determines the Market Value of your property (this will be the subject of an entirely different post). Then they divide it by 10 to come up with your Assessed Value. I have no idea why they do this. So you think you are getting a deal? They then multiply that by an Equalization Factor to determine your Equalized Assessed Value. Then they subtract your Homeowner Exemption (assuming you remembered to file for it). Then they multiply by the Tax Rate to determine your Property Taxes. Here is an example for 2012 from that report I linked to above:

So there are 3 different factors involved and they’ve spent the last 6 months trying to figure out 2 of them – the equalization factor and the tax rate. Why are there 3 separate factors when you can combine them into a single factor? I don’t know but apparently someone wasn’t paying attention in math class when they explained the associative property of multiplication. If you came up with a single factor it would be 1.79% and then you would subtract $448 for your homeowner exemption.

What’s Happening To Chicago Property Taxes In 2012?

Using the example above you can calculate your 2012 Chicago property tax bill right now so that you can get a jump start on abandoning the city. Just go to the Cook County Assessor’s site to look up your assessed market value and then run through the calculation above – or you can use my math short cut. (Better yet you can now look up your taxes at the Cook County Property Tax Portal)

But now that you know how to figure out your own tax situation let’s look at the bigger picture for Chicago so that we can draw some general conclusions. You know that 1.79% factor I came up with for 2012? Well, for 2011 that factor was 1.62%. In other words, if your market value stayed the same your taxes are going to go up by 10.7%!!! And the homeowner exemption has gone down to $7,000 from $12,000, which is going to cost you another $207!

But that doesn’t mean that the average Chicago home owner is going to get hit with a 10.7%+ property tax increase because there are a lot of moving parts in this equation. For starters don’t you know that the city/county starts with how much money they need and then spreads that across the taxable properties? So, really the big driver in all of this is how much money the local government wants to spend. And digging into that report I linked to above it appears that Chicago decided that they only needed 1.84% more in 2012 than they did in 2011. So all else being equal you would expect everyone’s tax bill to go up by about 1.84% – and that’s basically true.

OK, but exactly how does a 1.84% increase in taxes tie in with a 10.7% increase in the tax factors? Well, properties in the city of Chicago were reassessed for 2012 and because of the declining real estate market property values went down. No surprise. Digging into that report again it looks to me like the total tax base went down by about 8%. That’s the combined effect of declining property values and any growth in the tax base from new construction. If you do the math that means that you need to increase the tax rate by about 10.7% in order to get a 1.8% increase in property taxes on the smaller tax base.

What This Means For Your Property Taxes

What all this boils down to is that you really need to keep an eye on your assessed market value. On average it should have gone down but no doubt it went up for plenty of people and it surely went down more than average for plenty of others. And don’t forget that everyone is out there trying to get their property values lowered (that’s the appeals process), which is contributing to the decline in the tax base and the offsetting increase in the tax rates. In other words if you don’t minimize your assessed market value you are going to get stuck with ever increasing property taxes.

The following posts, written at a later date, cover how to appeal your property taxes:

How To Appeal Your Cook County Property Taxes – The Basics

How To Appeal Your Cook County Property Taxes – The Details

If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think I’m the next Kurt Vonnegut you can Subscribe to Getting Real by Email.