On the same day (yesterday) that Crain’s reports that Illinois is in the “deepest financial hole ever” we find out from RealtyTrac that the Chicago area has the second highest level of zombie foreclosures in the country, behind Miami, and Illinois is also in second place among states. Zombie foreclosures are homes that have been abandoned by their original owners prior to the bank repossessing them. It makes me wonder if maybe Illinois will turn into a zombie state when it comes time to pay off all the debt we’re accumulating.

Nationwide and in the city of Chicago one in 5 homes in foreclosure are zombies. In an article entitled Zombie Foreclosures: The Vacant Dead, RealtyTrac discusses the well known problems associated with these properties: detracting from neighborhood appearance, loss of tax revenue, attracting crime, and lowering neighborhood property values.

I actually find it odd that the original homeowners are abandoning these properties since they can usually live in them basically for free for 2 – 3 years before the bank finally takes possession. Maybe these homes are in such sorry shape that people don’t even want to live in them for free. And the banks are certainly in no hurry to take them on either since the cost of dealing with them could easily exceed the value that the banks can get from them.

So cities have thousands of these properties that no one is really taking responsibility for. Technically the homeowner is responsible but good luck tracking them down and getting them to do anything about the problem. And the banks don’t really have legal authority to do anything with the property until they take possession, which they are in no hurry to do.

Therefore, there are really only two possible solutions for dealing with these properties: 1) sell them to new buyers who will fix them and take care of them or 2) demolish them. However, there are legal barriers for pursuing either of these solutions if the owner is MIA and doesn’t want to be found. And you can’t exactly demolish a single condo unit.

February Foreclosure Market Report

RealtyTrac also released their February Foreclosure Market Report yesterday that showed a continued decline in foreclosure activity throughout the nation and also in Chicago. As RealtyTrac pointed out national activity hit a more than 7 year low – equivalent to the December 2006 level.

Looking at the Chicago data below you can see the same steady decline in foreclosure activity, with the most notable declining component being the defaults (in blue). When property values are rising and the job picture is improving people are less likely to default on their mortgages.

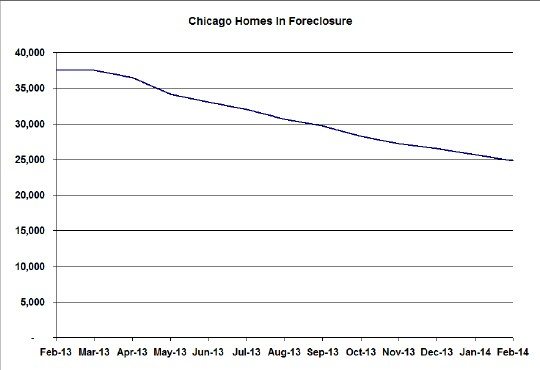

Also note in the graph below that total activity for Chicago hit the lowest level since I’ve been tracking it.

Commenting on the national picture, Daren Blomquist, vice president at RealtyTrac, focused on the zombie foreclosure problem:

Cold weather and a short month certainly contributed to a seasonal drop in foreclosure activity in February, but the reality is that new activity is no longer the biggest threat to the housing market when it comes to foreclosures. The biggest threat from foreclosures going forward is properties that have been lingering in the foreclosure process for years, many of them vacant with neither the distressed homeowner or the foreclosing lender taking responsibility for maintenance and upkeep of the home — or at the very least facilitating a sale to a new homeowner more likely to perform needed upkeep and maintenance.

Chicago Shadow Inventory

All of this data is fine but it’s a little hard to interpret with all the duplication between different phases of the foreclosure process. Instead, what people really should focus on is the trend in the backlog of foreclosures and the good news is that Chicago’s shadow inventory is in a steady state of decline as you can see in the graph below. I finally have 12 months of data and in the last year I can tell you that we have whittled down the foreclosure inventory by close to 13,000 units. It would be nice to imagine that we can continue to work through this pile at the same rate for some time but I would imagine that things will start to slow down eventually as we hit the more intractable properties.

If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think I’m the next Kurt Vonnegut you can Subscribe to Getting Real by Email. Please be sure to verify your email address when you receive the verification notice.