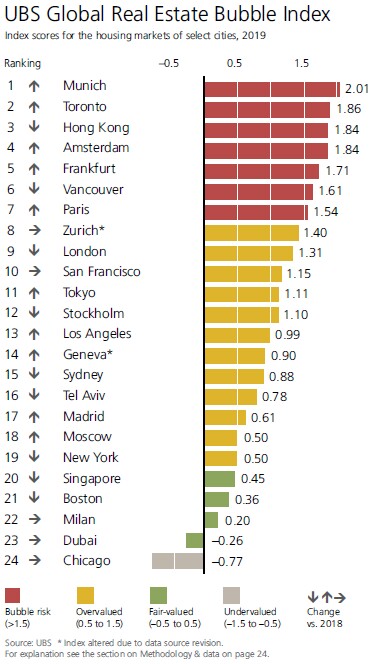

For many years now the Chief Investment Office of UBS has produced an annual analysis of the real estate markets in the major global cities to determine their relative levels of over or under valuation along with their bubble risk. In these reports Chicago has consistently ranked as having the cheapest global real estate market with the lowest risk of being in a bubble and the results were the same in this year’s Global Real Estate Bubble Index analysis.

According to the report “the UBS Global Real Estate Bubble Index traces the fundamental valuation of housing markets, the valuation of cities in relation to their country and economic distortions (lending and building booms)….[It’s] a weighted average of five standardized city sub-indices”:

- Price-to-income

- Price-to-rent

- Change in mortgage-to-GDP ratio

- Change in construction-to-GDP ratio

- Relative price-city-to-country indicator

They are looking for “patterns of property market excesses” which would manifest as “a decoupling of prices from local incomes and rents, and imbalances in the real economy, such as excessive lending and construction activity.”

Based on the index value each city falls in one of 5 categories:

- < –1.5: depressed

- –1.5 to –0.5: undervalued

- –0.5 to 0.5: fair valued

- 0.5 to 1.5: overvalued

- > 1.5: bubble risk

They looked at 24 cities, none of which were depressed, and, as in the past, Chicago was the only city in the undervalued bucket with an index value of -0.77. Only 4 cities were considered fairly valued so the other 19 were either overvalued or at risk of being in a bubble.

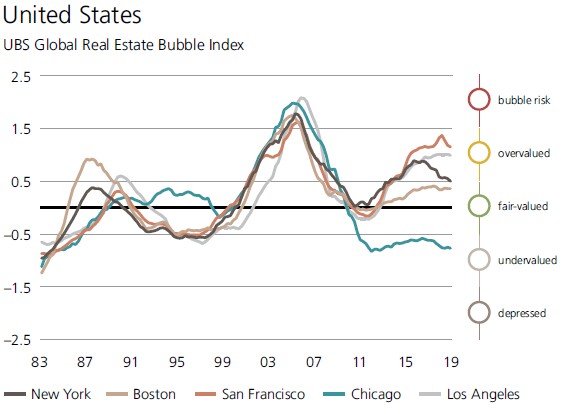

In their report UBS shows how the index for the US cities has trended since 1983 and you can see how Chicago pulled away from the other US cities around 2009.

This result should come as no surprise considering that Chicago’s home price appreciation has lagged the rest of the country’s for several years now as I’ve been reporting. As noted above, prices relative to the rest of the country is one of the inputs into the bubble index. Two other inputs lowering Chicago’s index are its extremely low price to income and price to rent ratios. The report has some great comparison charts on these two measures. UBS attributes Chicago’s depressed prices to weak economic development and its fiscal challenges.

The UBS report makes a couple of other interesting global observations that are worth noting. First, they suggest that low interest rates have probably fueled the bubble risk in the Eurozone. Second, they point out that price appreciation has slowed down in a majority of the cities studied – prices can only go up so much before affordability becomes too heavy a weight to bear. Fortunately, these are two problems that Chicago doesn’t have.

#ChicagoHomePrices #HousingBubble #BubbleIndex #ChicagoRealEstate

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service real estate brokerage that offers home buyer rebates and discount commissions. If you want to keep up to date on the Chicago real estate market or get an insider’s view of the seamy underbelly of the real estate industry you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.