It looks like the Chicago real estate market turned in another disappointing month in November. Home sales were down 1.6% from last year. Of course, the Illinois Association of Realtors will see it even more negatively in about 2 weeks when they report a decline of 2.0%. However, I’m thinking that these estimates might be off a bit. When I look back to last November’s data it looks to me like either they pulled the data later in the month or there were just fewer reporting lags – i.e. the benchmark was higher than normal.

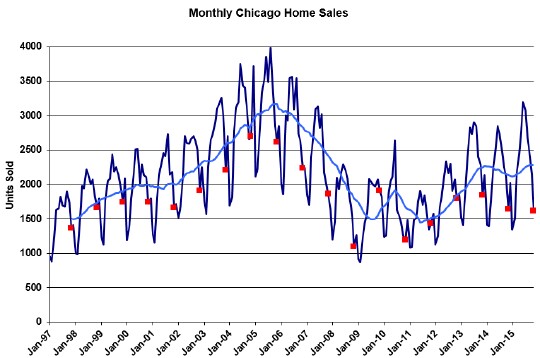

Nevertheless, the effect I’m worried about here is small and at best November was flat to last year. It’s still clear that home sales have lost a lot of their momentum in the past few months. You can see it in the long term sales history graph below where all the November points are flagged in red and the light blue line is a 12 month moving average. Note that this November was lower than both 2012 and 2013.

Of course, none of this is a surprise in light of the extremely low inventory levels out there. How can you have strong sales when the shelves are bare?

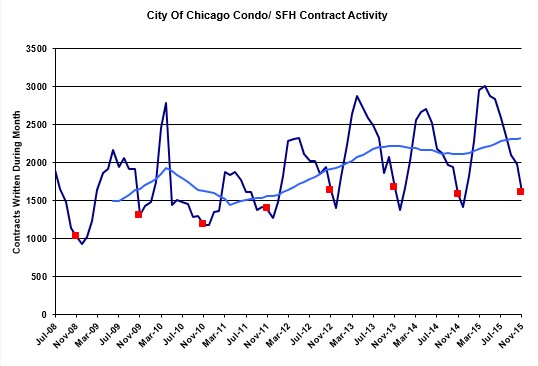

Chicago Home Contract Activity

And I really don’t see sales getting any stronger any time soon with no gains in contract activity – a precursor to closings. November contract activity has been fairly static for the last 4 years. My guess is that this year was up only 1.4% from last year.

Pending Home Sales

One big surprise for me is that somehow pending home sales managed to rise in this environment. At the end of November it stood at a 2.37 month supply of homes vs. 2.22 months last year. So this reserve of properties under contract could help keep the closing pipeline flowing at a better level. And please note that I’m not talking about the obvious uptick in the graph below because that’s normal seasonality at this time of year.

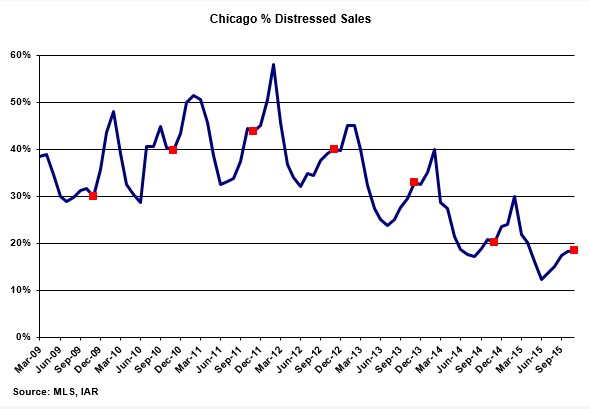

Distressed Home Sales

As we’ve been anticipating the decline in distressed home sales as a percentage of the total has almost run it’s course. Yes, November dropped to 18.6% vs. 20.2% last year but that size decline is nothing like what we’ve seen over the previous 3 years. We must be coming close to the bottom in these numbers. And as I demonstrated about three weeks ago not all areas of Chicago have recovered from their distressed sales problem.

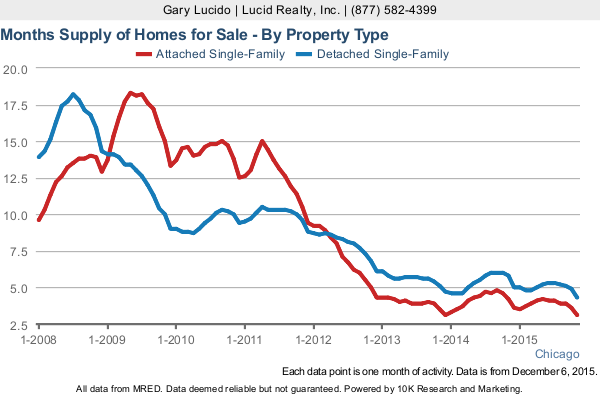

Chicago Home Inventory

The one bright spot, and probably the key driver in lower home sales, is the extremely low level of home inventory in the city. November hit yet another record low inventory level with attached homes dropping from 4.2 months of supply to 3.1 months while detached inventory went from 5.8 months of supply to 4.3. Those are just huge drops.

I say bright spot because with inventory this low home prices almost certainly have to rise faster than they have been – well, at least that’s bright for sellers and owners.

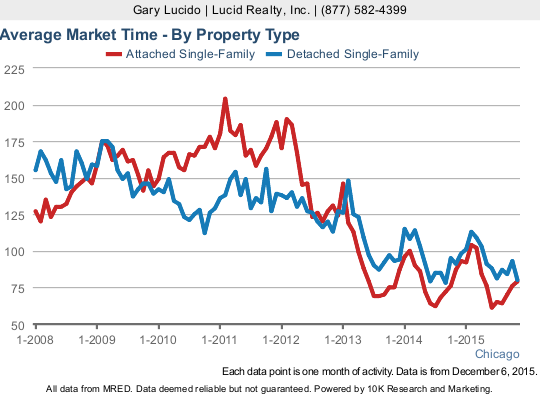

Chicago Home Sale Market Times

And with inventories so low I’ve been remarking how peculiar it has been that market times have not really dropped substantially from last year. Well, this month the universe became more rational because there were in fact significant drops in market times. Attached market times fell from 87 days to 79 days and detached market times fell from 91 days to 80 days. Again, this should bode well for home prices – not so much for home buyers.

#realestate #chicagorealestate

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service discount real estate brokerage. If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think he’s the next Kurt Vonnegut you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.