It seems like everyone was trying to get to the July Case Shiller home price index numbers at the same time this morning. They were released at 8 AM Central time but the site was slammed for the first 9 minutes. I guess it’s really popular data.

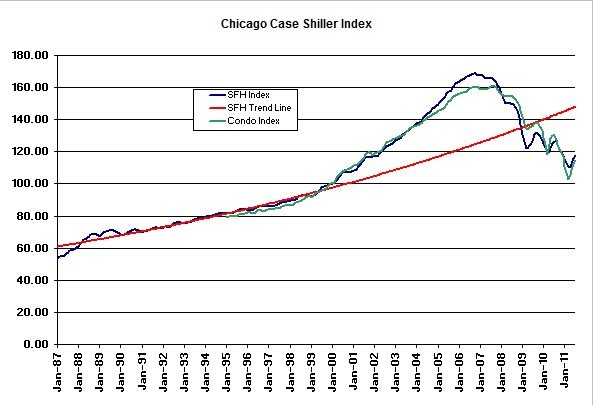

What the data showed is that in the month of July single family home prices in Chicago rose by 1.9% while condo prices rose by 1.8%. That’s the 3rd and 4th month of increases respectively for those two measures. That brings single family home prices in Chicago up almost 7% from their recent lows and condo prices up almost 12% from their recent lows. That’s quite a recovery but we’ve seen this movie twice before. So is the bounce real this time? After all, we’re 20.5% below the long term trend line for Chicago – see the graph below – and, as I’ve pointed out before, home inventories are running historically low right now, which should support prices.

However, in the Case Shiller press release S&P urged people to not yet get too excited about these numbers: “… if you look at the state of the overall economy and, in particular, the recent large decline in consumer confidence, these combined statistics continue to indicate that the housing market is still bottoming and has not turned around.”

Of course, single family home prices are still 30.1% below the bubble peak and condo prices are 28.7% below that fictional number. Prices are essentially back to March 2002 levels for single families and back to May/June 2001 levels for condos. That’s basically 10 years with no price appreciation for a city that believed that home prices always go up when I moved back here in 1999.

From this time last year single family home prices are down 6.6% while condo prices are down 11.9%.

To put everything in perspective I have my cute little chart of the Case Shiller index going back to January 1987 along with the long term trend line in red.