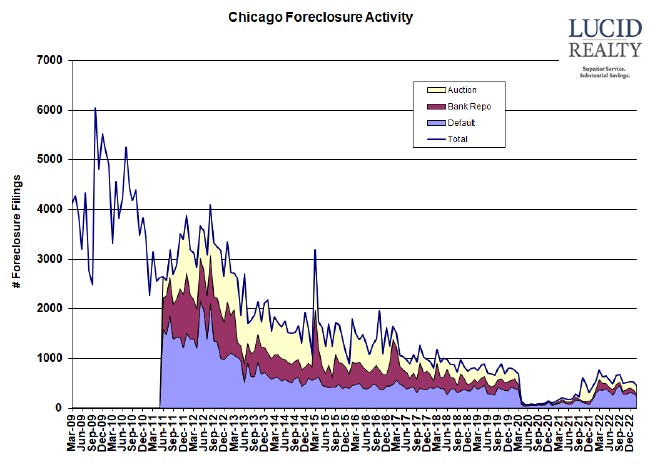

Earlier this month ATTOM released their February Foreclosure Market Report which showed a trivial decline from January and an 18% increase in foreclosure activity from the previous year. They also provided me with city level data that allowed me to update my Chicago foreclosure activity graph below. That graph paints somewhat of a different picture than that of the nation. Whereas the national numbers increased from a year ago Chicago foreclosure activity declined. In fact we hit a 13 month low and the graph seems to suggest that we are on a downward trajectory. We are also at a lower level than at any time before the pandemic.

Rob Barber, chief executive officer at ATTOM, repeated a popular theory about what might keep foreclosure activity suppressed going forward: “…with historically high levels of home equity flowing from a decade of rising values, we may be seeing a growing number of delinquent mortgage payers with at least the option to sell before facing foreclosure.” Whereas the nation may not yet be seeing the benefits from this perhaps Chicago is. And don’t forget that the job market is still pretty strong despite Jay Powell’s attempts to kill it – not that I blame him.

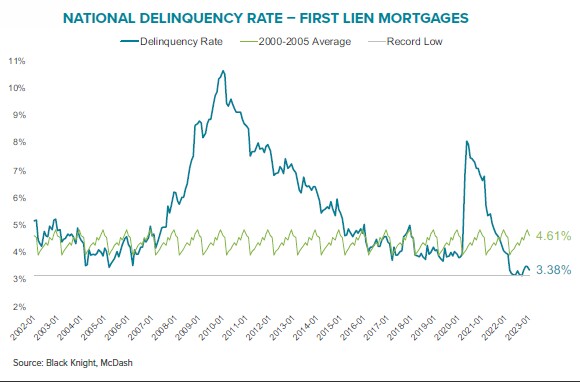

As a leading indicator of where foreclosures are heading let’s check in on Black Knight’s January Mortgage Monitor Report. In particular, they report a slight increase in the delinquency rate from 3.08% the previous month to 3.38% in January. I have no idea why their graph looks like it’s pointing down though. Nevertheless, on a historic basis 3.38% is pretty darn low and bodes well for a low foreclosure rate.

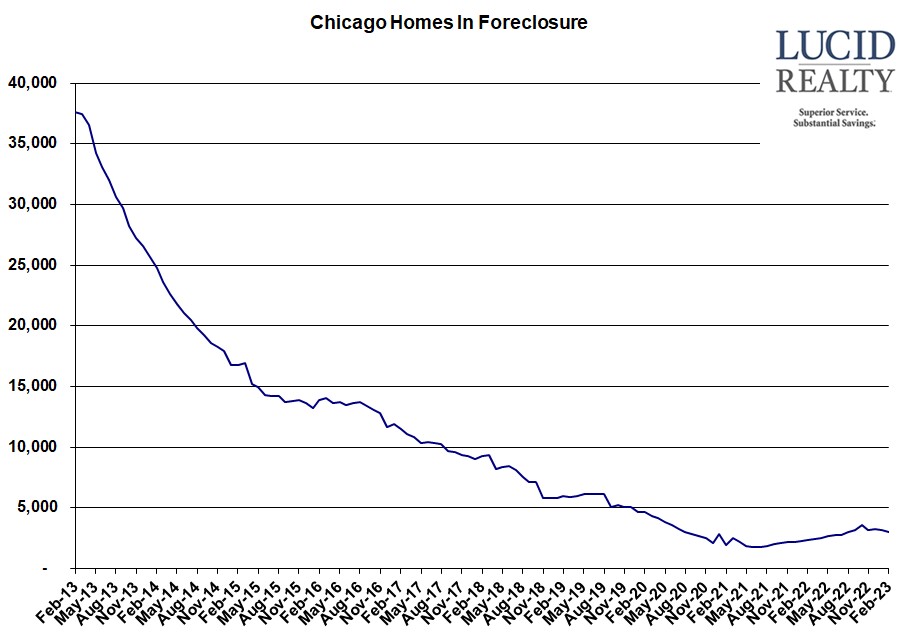

Chicago Shadow Inventory

My theory that the number of Chicago homes in the foreclosure pipeline had peaked seems to be validated by recent data. Once again the number dropped and you can see how it appears to actually be trending down in the graph below. We’ve now dropped a total of 542 units since the October peak. This is perhaps more relevant to the Chicago housing market than overall foreclosure activity because this is the shadow inventory that hangs over the market and impacts prices.