The good news is that the latest Case Shiller Chicago home price index for June shows continuing gains but the bad news is that those gains continue to get smaller and smaller each month. In fact, of all the 20 metro areas covered by Case Shiller Chicago came in at last place for the first time. Heck, even Detroit is doing way better than Chicago – of course, they are crawling out of the pits.

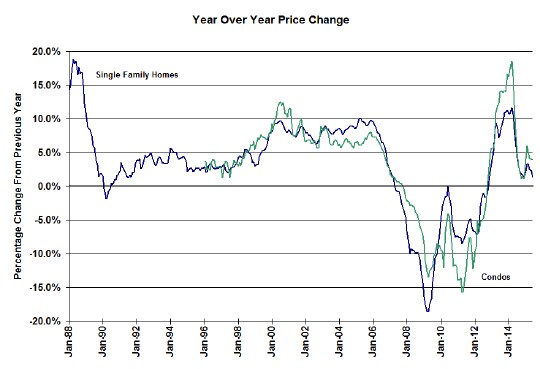

The graph below shows the year over year Chicago home price gains for single family homes and condos/ townhomes. The June Case Shiller numbers show that single family homes were up 1.4% over last year, while condos and townhomes were up a much healthier 3.9%. The 20 city list only includes single family home data and the second from the bottom city was Washington DC at 1.6%. Detroit, BTW, is pretty much in the middle of the pack with a 5.7% year over year gain.

Keep in mind, of course, that these numbers are for the entire Chicago metro area and therefore reflect an average of many different areas. Obviously there are large areas of Chicago that are doing much better than 1.4%.

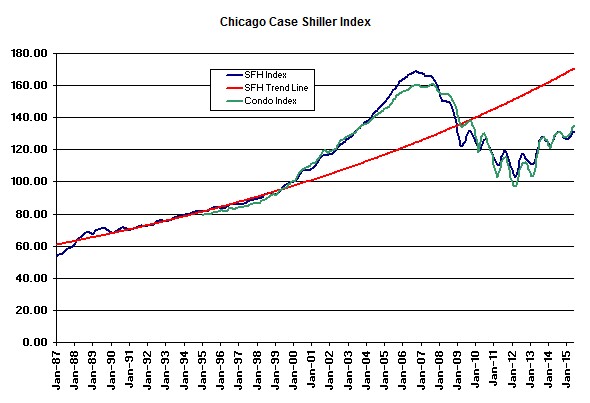

I’ve got the actual index values plotted in the graph below along with the long term trend line for single family homes, which I extrapolated from the pre-bubble years. Single family home prices were up 0.7% from May, while condo and townhome prices were up 1.0%.

At this point single family home prices are still 21.9% below the bubble peak but at least they have recovered 28.2% from the bottom. Condos and townhomes are doing a bit better since they are only off 15.9% from the peak and have recovered 39.1% from the bottom.

Putting these numbers in historical perspective, single family home prices are still lower than they were during the entire period from June 2003 through January 2009 and condo/ townhome prices are still lower than they were from October 2003 through November 2009. And a lot of people bought during that time period.

Now, back to that long term trend line for a minute. We’re still 22.8% below that trend line and if you look at the rising portion of the lines over the last few years you’ll see that it doesn’t really look like we’re closing that gap at all. The pre-bubble period in Chicago had a much higher inflation rate than we do now so that probably helped light a fire under housing prices in the area. Now, inflation is almost non-existent so that fuel is missing from the equation. We may never get back “on track” unless the local economy really heats up.

In the commentary on the national picture David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices, talked about some of the potential dangers that might lie ahead:

Two possible clouds on the horizon are a possible Fed rate increase and volatility in the stock market. A one quarter-point increase in the Fed funds rate won’t derail housing. However, if the Fed were to quickly follow that initial move with one or two more rate increases, housing and home prices might suffer. A stock market correction is unlikely to do much damage to the housing market; a full blown bear market dropping more than 20% would present some difficulties for housing and for other economic sectors.

A lot of people have speculated about what a significant stock market correction might do to the housing market. I think at the high end, where stocks could be a significant portion of a home buyer’s net worth, it might pose a real problem. But for the average person it shouldn’t be that big of a problem – unless they have their future down payment invested in stocks. So, I will dispense a little bit of common financial advice here: it’s always a bad idea to have money invested in stocks if you think you are going to need it any time soon. “Soon” of course is open to interpretation but even 5 years could be too soon for a stock market investment. And it’s always a good idea to talk to a financial adviser about these matters since you can’t believe anything you read on the Internet.

#CaseShiller #Realestate #HomePrices

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service discount real estate brokerage. If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think he’s the next Kurt Vonnegut you can Subscribe to Getting Real by Email. Please be sure to verify your email address when you receive the verification notice.