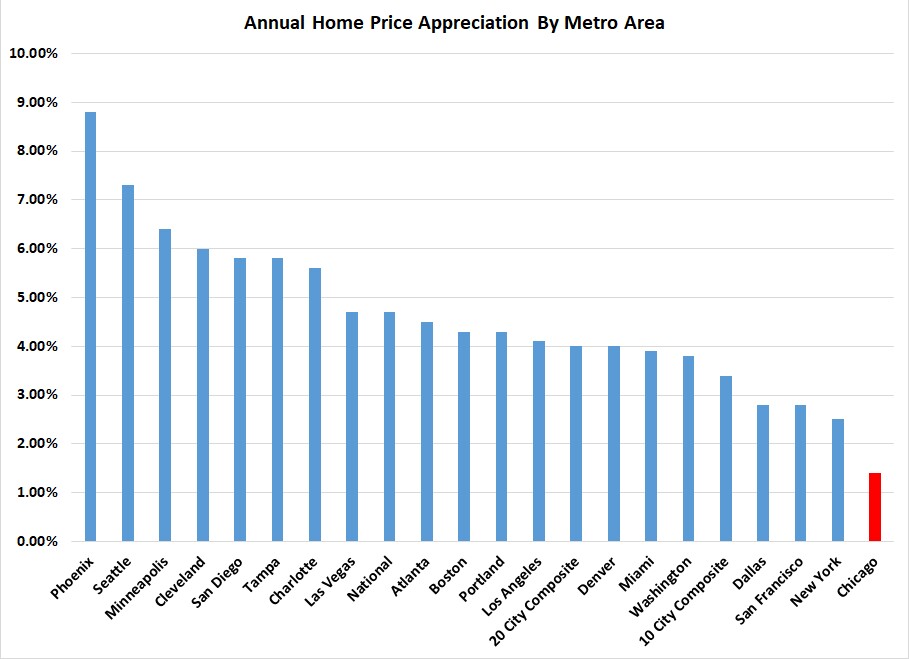

Another month has come and gone and once again Chicago area annual home price appreciation is the slowest among the 20 largest metro areas. This is according to the April Case Shiller home price indices released this morning by S&P CoreLogic. The graph below puts it in perspective. Chicago area single family home prices rose by just 1.4% over the last year while the national average was up by 4.7%. Even the second worst metro area – New York – was up a lot more at 2.5%. And 1.4% is slightly lower than March’s 1.5% appreciation rate. Sad.

Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices, pointed out that “The price trend that was in place pre-pandemic seems so far to be undisturbed, at least at the national level. Indeed, prices in 12 of the 20 cities in our survey were at an all-time high in April.” But not so much in the Chicago area.

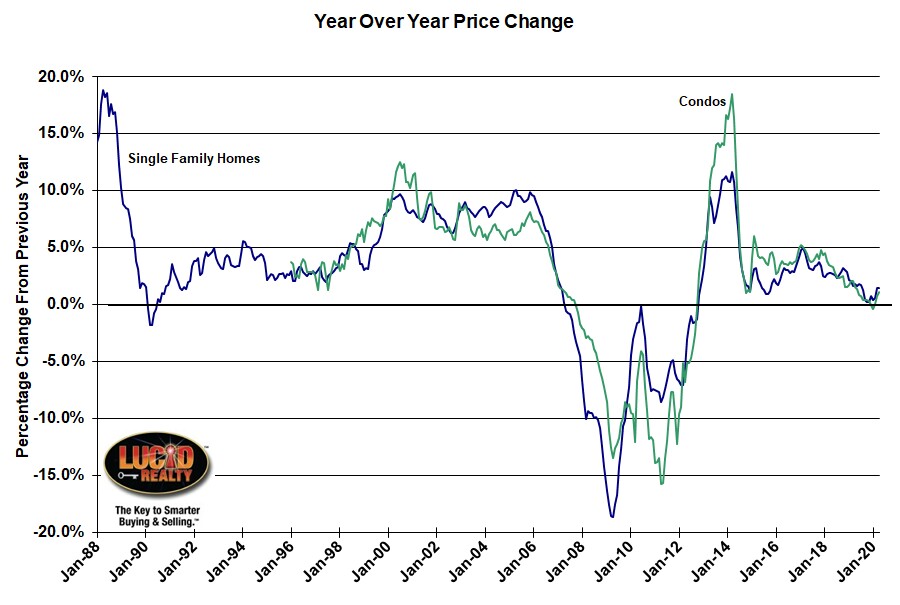

The graph below shows the historical annual appreciation rates for both Chicago area single family homes and condos. The good news is that Chicago area single family home prices have now risen for 90 consecutive months and we’re seeing a little bit of an increase in the appreciation rate off of the lows hit in October and November. Condos appreciated by 1.1% in April, which is the highest rate in 11 months.

Case Shiller Chicago Area Home Price Index By Month

The graph below shows the historical values of the Chicago area Case Shiller home price indices. April single family home prices rose by 1.1% from March and condo prices rose by 1.3% as we are in the seasonal upswing in home prices.

You can tell by just looking at the graph that price gains are petering out. Although single family home prices are up 42.2% from the bottom and condos are up 56.0% we still have not quite reached the peak of the bubble. Single family home prices are still 13.4% below peak while condos are 5.8% below peak. And we’re not even close to getting back to the red trendline based on pre-bubble prices. Single family home prices are running 28.2% below that benchmark.

From a historical perspective single family home prices are actually lower than they were during the entire period from September 2004 – October 2008 and condo prices are lower than the July 2005 – October 2008 period.

#CaseShiller #ChicagoHomePrices #HomePrices

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service real estate brokerage that offers home buyer rebates and discount commissions. If you want to keep up to date on the Chicago real estate market or get an insider’s view of the seamy underbelly of the real estate industry you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.