According to yesterday’s release of the December Case Shiller Home Price Index by Dow Jones S&P CoreLogic the nation’s single family home prices rose by 6.3% in 2017 with Seattle and Las Vegas gaining by double digits for the year. Unfortunately (unless you don’t own a home here), the Case Shiller Chicago area index was up by only 2.6% which put us in last place among 20 major metro areas. Compare that to second to last Washington DC with a 2.8% gain.

I have the year over year gains plotted in the graph below going back to 1988. If you look at the graph closely you can see that 2.8% is one of the lowest gains we’ve reported in almost 2 years – 21 months to be exact. However, it is the 62nd consecutive month of one year gains.

You can also see that Chicago area condo prices have been rising faster than single family home prices for a while now and December was no exception with a 4.4% gain for the year.

The release goes on to voice concern about home prices rising faster since the bottom of the housing crisis than both inflation and the average gain from 1976 – 2017. However, I don’t think any of those concerns apply to the Chicago area since we have a lot of ground to cover still before getting back to the peak (see below) while the nation as a whole, and the major metro areas, have already come close to the peak or surpassed it. Not to mention that one should expect prices to rapidly rise during a recovery…so why are they worried about this?

Case Shiller Chicago Area Home Price Index By Month

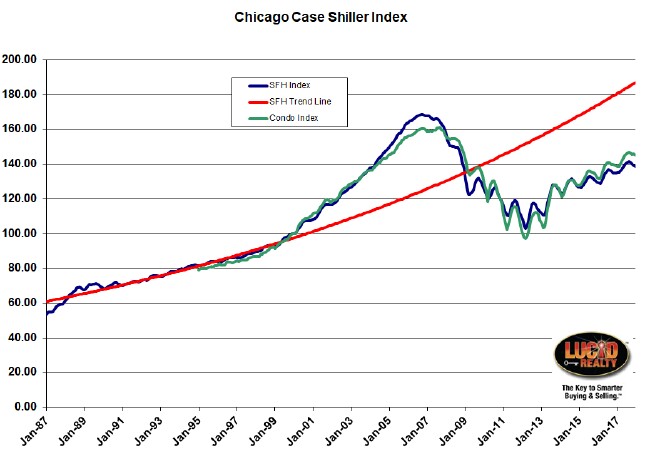

The graph below shows the Case Shiller index values going back to 1987 for both condos and single family homes. In December single family home prices fell by 0.6% and condo prices fell by 0.5% from November. A decline is normal at this time of the year.

As I was discussing above, Chicago area home prices are still well below their peak value in contrast to most of the rest of the country. Single family home prices are 17.8% below their peak while condo prices are doing a little better with only a 9.7% shortfall. In fact, single family home prices are below where they were during the entire period from February 2004 until December 2008 and condo prices are below their level from January 2005 through December 2008.

And if you extend the pre-bubble home price trend (red line in graph below) you see that we are 25.9% below that. But we have still recovered a lot of lost ground from the bottom of the crisis. Single family home prices have risen by 34.8% and condo prices have risen by 49.4%.

#ChicagoHomePrices #CaseShiller

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service discount real estate brokerage. If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think he’s the next Kurt Vonnegut you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.