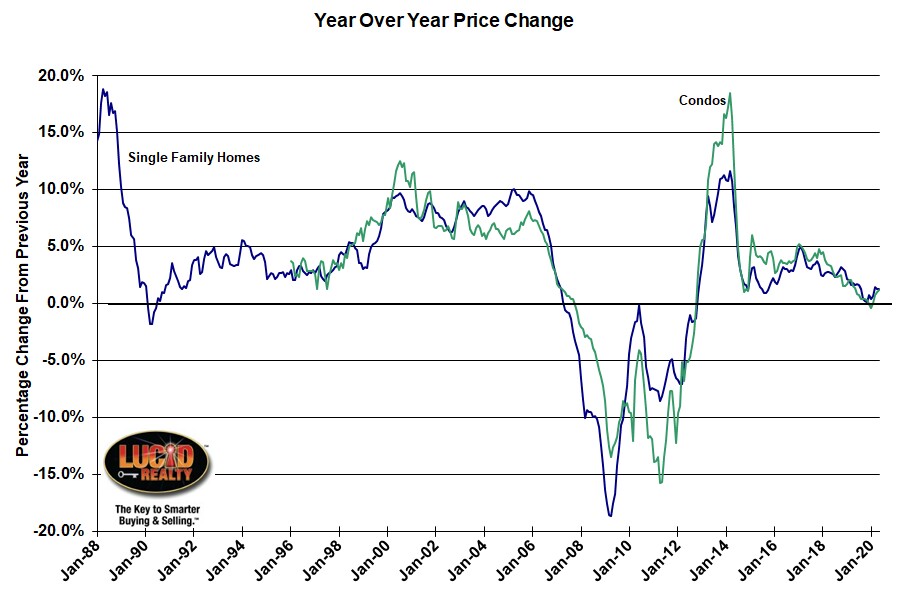

The Case Shiller Chicago area single family home price index has been trailing the rest of the country for quite some time now but this morning S&P Dow Jones released the CoreLogic Case-Shiller home price indices for May and Chicago looks less bad. Not because home prices are growing any faster here but because the rest of the nation’s home price appreciation slowed down a bit with only a 4.5% gain over last year. Phoenix had the strongest showing with a 9.0% gain and once again Chicago came in last place with a paltry 1.3% gain. New York came in second to last place with a 2.1% gain.

Condo prices in the Chicago area advanced in May by 1.2% over last year, the 4th month in a row where the annual appreciation rose from the previous month, after bottoming out in January with a 0.3% decline in prices.

Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices, commented on the slowdown in home price appreciation:

The National Composite Index rose by 4.5% in May 2020, with comparable growth in the 10- and 20-City Composites (up 3.1% and 3.7%, respectively). In contrast with the past eight months, May’s gains were less than April’s. Although prices increased in May, in other words, they did so at a decelerating rate. We observed an analogous development at the city level: prices increased in all 19 cities for which we have data, but accelerated in only 3 of them (in contrast with 12 cities last month and 18 the month before that).

Case Shiller Chicago Area Home Price Index By Month

The graph below shows the monthly Case Shiller Chicago area home price indices for both single family homes and condos going back to the beginning of 1987 along with a trendline based on home price growth prior to the housing bubble. May single family home prices rose 0.7% from April and condo prices rose 0.9%.

Sadly, after nearly 14 years, we have not even recovered to the bubble peak levels – unlike most other parts of the country that have actually exceeded that peak. Single family home prices are still 12.8% below the peak while condo prices are 5.0% below peak. And catching up to that trend line is a pipe dream since we lag it by 27.9% and the gap seems to be widening, not narrowing.

Chicago area home prices are still so weak that, on average, if you had purchased a single family home between October 2004 and September 2008 or a condo between September 2005 – September 2008 you would still be under water. The only good thing you can say about Chicago area home prices is that they have rebounded quite a bit from the bottom. Single family home prices have risen 43.0% and condo prices have risen 57.2%.

#ChicagoHomePrices #CaseShiller #HomePrices

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service real estate brokerage that offers home buyer rebates and discount commissions. If you want to keep up to date on the Chicago real estate market or get an insider’s view of the seamy underbelly of the real estate industry you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.