I’m running out of ways of saying that Chicago area home prices are increasing reaaaalllllly slooooowwwwwwllllly. This morning Dow Jones S&P CoreLogic released their February Case Shiller home price index for the nation and the 20 metro areas they track. While the Case Shiller Chicago area single family home price index showed year over year gains for the 64th consecutive month we once again ranked near the bottom of 20 metro areas. We came in 19th place, just ahead of Washington DC, with a mere 2.6% gain over last year. As the release points out, a few cities “out west” are blowing it away with double digit gains – Seattle, San Francisco, and Las Vegas. And the 20 metro area composite was up 6.8% over last year.

The graph below shows Chicago’s history of year over year price changes for both single family homes and condos. Condos continue to do better than single family homes and clocked a 4.0% increase over last year in February.

David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices, made a couple of interesting observations. First of all, since the bottom of the market the nation’s home prices have increased by 6% per year on average, which is very close to the average price increase from January 1992 to the top of the market. And that was an exceptionally strong period that averaged 6.1% gains per year.

David went on to discuss the connection between employment gains and home price increases:

With expectations for continued economic growth and further employment gains, the current run of rising prices is likely to continue. Increasing employment supports rising home prices both nationally and locally. Among the 20 cities covered by the S&P CoreLogic Case-Shiller Indices, Seattle enjoyed both the largest gain in employment and in home prices over the 12 months ended in February 2018. At the other end of the scale, Chicago was ranked 19th in both home price and employment gains; Cleveland ranked 18th in home prices and 20th in employment increases. In San Francisco and Los Angeles, home price gains ranked much higher than would be expected from their employment increases, indicating that California home prices continue to rise faster than might be expected. In contrast, Miami home prices experienced some of the smaller increases despite better than average employment gains.

It’s all about the jobs. And I wonder if a surge in Miami home prices is coming down the road given the disconnect between employment gains and home prices.

Case Shiller Chicago Area Home Price Index By Month

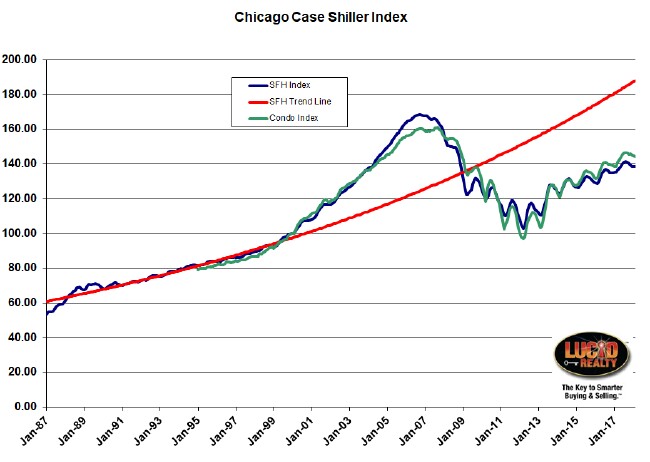

When you look at the entire history of the Case Shiller index for single family homes and condos in Chicago below you can see just how lame our recent home price gains have been. The red trend line was established from the period prior to the housing bubble and we far exceeded it during the bubble but then fell way below it afterwards and have not caught up since. And, as you can tell, we are not on track to ever catch up to it, currently falling short by 26.2%.

We haven’t even gotten back to the bubble peak yet. Single family home prices are still 17.8% below the top and lower than the entire period from February 2004 – December 2008, though they have recovered 34.9% from the bottom of the market. Condo prices are still 10.5% below the top and lower than the period from December 2004 – December 2008, but up 48.1% from the bottom.

Looking at the graph you can also see that condo prices have pulled ahead of single family home prices. That trend reversed a bit in February, with condo prices down 0.4% from January while single family home prices were up 0.1%. Neither of those changes are that unusual for this time of the year.

#ChicagoHomePrices #CaseShiller

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service discount real estate brokerage. If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think he’s the next Kurt Vonnegut you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.