The Case Shiller Home Price Index for April just came out a few minutes ago and for the first time in many months there are positive signs in the numbers for Chicago. A lot of people must have been interested in these numbers because the S&P servers crashed for 11 minutes after the release of the data.

The Case Shiller Home Price Index for April just came out a few minutes ago and for the first time in many months there are positive signs in the numbers for Chicago. A lot of people must have been interested in these numbers because the S&P servers crashed for 11 minutes after the release of the data.

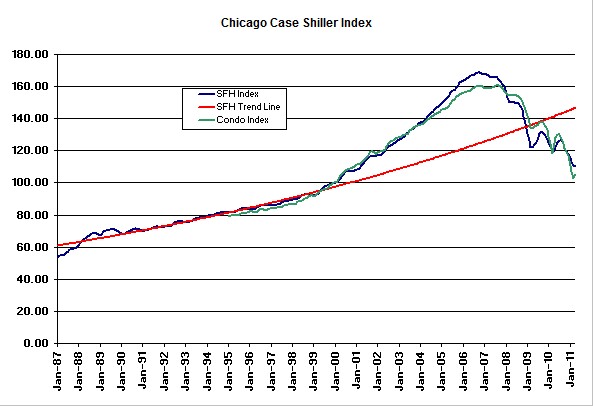

Single family home prices in Chicago fell only slightly from March – down only 0.4%, which is a smaller decline than we’ve been seeing lately. However, the big news was the condo prices in Chicago were actually up from April by 2.4% – the first increase in condo prices since July of last year. Since then condo prices have been falling like a rock, as you can clearly see in the graph below.

The red line in the graph above represents the long term trend line for single family home prices in Chicago and as you can see we are well below the “normal” level of home prices.

Single family home prices are down 8.6% from last April – a larger number than recent months only because last April was an up month for home prices. Condo prices are down 15.7% from last year.

Chicago single family home prices have still lost almost 35% of their peak value and are still back to April 2001 levels while condos have lost almost 35% of their peak value and are back to April 2000 levels.

Have An Opinion On Where Housing Prices Are Going?

Just wanted to remind you that we have a Chicago housing price forecast contest going on with $500 in prize money. The contest is a consensus forecasting project and as of the time of this post the consensus is that Chicago home prices will fall an additional 1.8% by June.