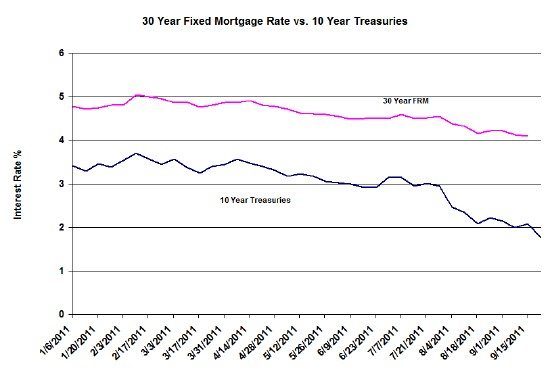

Just how low can mortgage rates go? It’s been incredible how mortgage rates just keep hitting new record lows every week. The last data I have shows the 30 year at 4.09%! And for over a year now I’ve been thinking that mortgage rates would spike up at any minute. I even tried locking in the “low rates” of about a year ago for myself through a short position in US Treasuries. That didn’t go so well and I’ve since closed that position.

A big part of the reason for the decline in mortgage rates is that they tend to sorta kinda track the 10 year treasury rate, which has been on the decline because the world has lost its appetite for risk and US debt is seen as the safest bet around (that’s incredible in and of itself). Then the European crisis hit hard and more investors flocked to lock in a 2% return for 10 years – what a deal.

As if all that weren’t enough…in the last few weeks there has been increasing speculation that the Federal Reserve was going to engage in a tactic that they last pursued in the 60s whereby they sold short term treasuries and bought longer term treasuries in an effort to bring down longer term rates without buying more government debt in total. This tactic earned the nickname Operation Twist after the Chubby Checkers single of the time. Yesterday the Federal Reserve formally announced their intention to twist once again and the 10 year rate dropped another notch and it has dropped again today.

But wait, there’s more! The Federal Reserve also announced their intention to continue to hold mortgage backed securities, reinvesting the proceeds of any maturities into more of the same. This is intended to help drive down mortgage rates in order to revive the housing market.

You can see the trend in both 30 year fixed rate mortgages and the 10 year treasury rate in the graph below.

One of the interesting features of that graph is that in the last couple of months the 10 year treasury rate has fallen faster than the 30 year mortgage rate – i.e. the spread (or risk premium) has widened. If that spread were to return to recent levels we could see mortgage rates decline even further. Who knows? Owning a home might eventually become free. Think that will help the housing market?