Today’s release of the Case Shiller Chicago home price index for August once again shows Chicago pretty much in last place among 20 metro areas in terms of price appreciation. There are a couple of different ways of looking at the data but they both give pretty much the same answer.

First, there’s the seasonally adjusted numbers which indicate that single family home prices declined 0.4% in August, which is the same or worse than every other metro area covered (20 in all) with the exception of Detroit. Detroit declined by 0.5%.

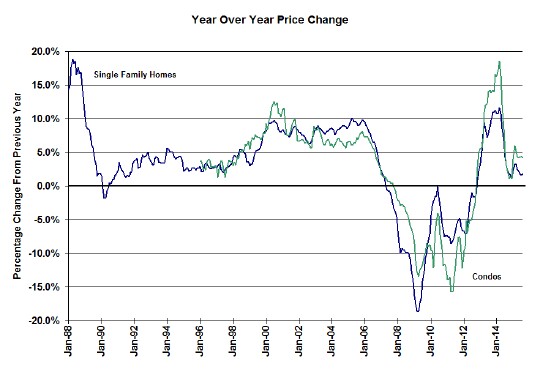

Then there’s the far simpler view of the world in the graph below which looks at year over year price changes. Single family home prices were up 1.9%, which is better than the gains of the last 2 months but still at the low end of the range for the 20 metro areas. Only New York was lower with 1.8% year over year gains.

Chicago Condo prices fared far better since last year with a 4.2% gain.

Looking at the monthly values of the Case Shiller Chicago home price index going back in time we see that August single family home prices rose 0.7% from July while condo/ townhome prices actually declined by 0.2%. We’re moving into the time of year when home prices start to decline so the drop in condo prices is not that unusual.

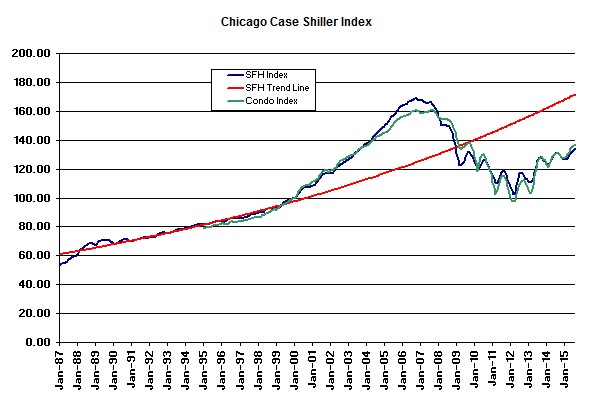

Single family home prices are still 20.4% below peak and condo prices are still 15.3% below peak. However, the good news is that single family home prices have bounced back 30.5% from the bottom and condo prices have recovered a whopping 40.2%. To put these numbers in historic perspective that means the single family home prices are still below the levels from September 2003 through December 2008 and condo prices are below the historically high prices of February 2004 through February 2009.

As for that red trend line in the graph below, which was derived from Chicago’s pre-bubble appreciation, we are still lagging it by 21.9%.

However, as David M. Blitzer, Managing Director and Chairman of the Index Committee for S&P Dow Jones Indices, points out even small gains in home prices are more meaningful today than they were several years ago because of the lower inflation rate today:

A notable part of today’s economy is the continuing low inflation rate; in the year to September, consumer prices were unchanged. Even excluding food and energy, the core inflation was 1.9%. One result is that a 5% price increase in the value of a house means more today than it did in 2005-2006, the peak of the housing boom when the inflation rate was higher. The rebound from the recent lows was faster than the 1997-2005 housing boom, and also much less driven by inflation.

#CaseShiller #Realestate #HomePrices

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service discount real estate brokerage. If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think he’s the next Kurt Vonnegut you can Subscribe to Getting Real by Email. Please be sure to verify your email address when you receive the verification notice.