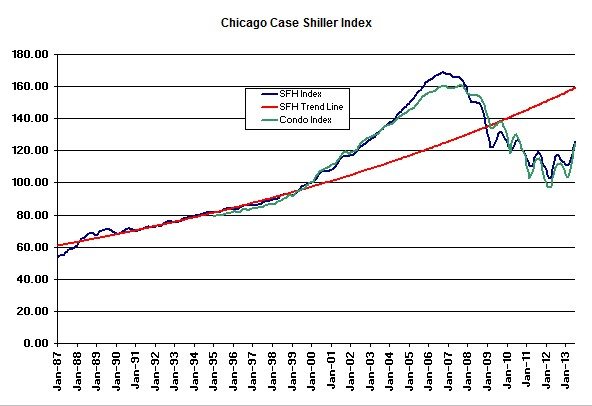

This morning’s release of the Case Shiller home price index for July shows prices for both single family homes and condos in Chicago hitting a 3 year high. The index for single family homes was up 3.2% over June while condo prices were up 3.9%. That 3.2% increase for single family homes was the highest in the nation for July. Going back to before the bubble peak that you can see in the graph below, this puts us at November 2002 levels for single family homes and July 2002 levels for condos.

People who bought a single family home at the lows of March 2012 (I managed to hit it just right but I’m not one to brag) are up on average 22.3% and condo buyers in that same time frame are up by 28.3%. However, that still leaves single family home prices 25.5% below the bubble peak and tracking 21.0% below the long term trend line while condo prices are down 22.5% from the peak.

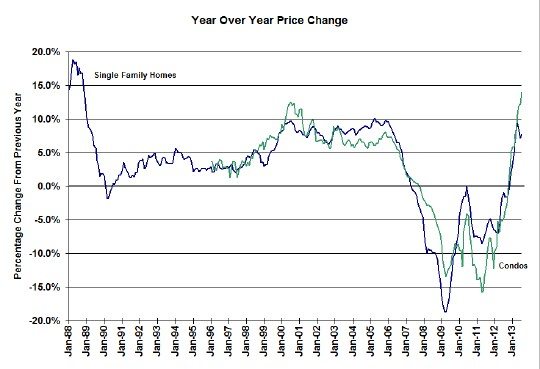

The year over year price changes are still solidly positive. The year over year change in single family home prices have notched up again to 7.7% after dropping last month but the big headline is that condo prices surged to 14.0% above last year at this time. That’s a record high one year gain for condo prices.

Commenting on the national home price picture, David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices said:

Home price gains are holding their 12% annual rate of gain established by the two Composite indices in April. The Southwest continues to lead the housing recovery. Las Vegas home prices are up 27.5% year-over-year; in California, San Francisco, Los Angeles and San Diego are up 24.8%, 20.8% and 20.4% respectively. However, all remain far below their peak levels.

Since April 2013, all 20 cities are up month to month; however, the monthly rates of price gains have declined. More cities are experiencing slow gains each month than the previous month, suggesting that the rate of increase may have peaked.

Following the increase in mortgage rates beginning last May, applications for mortgages have dropped, suggesting that rising interest rates are affecting housing. The Fed’s announcement last week that QE3 bond buying will continue for the time being may have only a limited, though favorable, impact on housing

Let me just point out that historically mortgage rates do not seem to have impacted the housing market that much. I know…strange but true.

If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think I’m the next Kurt Vonnegut you can Subscribe to Getting Real by Email. Please be sure to verify your email address when you receive the verification notice.