S&P just released the June Case Shiller home price index for Chicago and 19 other metro regions and it shows that prices for both single family homes and condos hit a 32 month high in Chicago. Single family home prices were up 3.3% from May while condominium prices were up an additional 4.6%. The Chicago increase was slightly smaller than the housing futures were predicting. The bid/ ask for the August contract (today’s release of the June index) was 122.8/123.4 before trading stopped yesterday but the index actually came in at 121.81. The next contract out is for the November release of the September index and the bid/ ask on that contract is 125.8/ 129.60 – in other words an increase of 3.3 – 6.4% from the current (June) level.

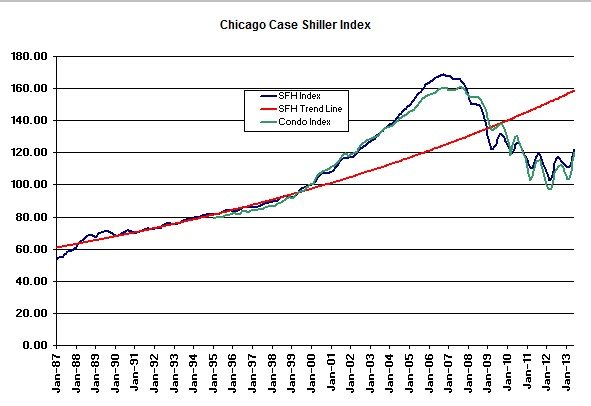

This puts single family home prices in Chicago back to June 2002 levels and condo prices back to April 2002 levels as you can see in the long term history graph below. The turnaround in prices is clear by now with single family home prices having risen by 18.5% from the low of March 2012 and condo prices having risen by 23.5% – a pretty good return if you just happen to have timed it perfectly. However, single family home prices are still 27.8% below the bubble peak and tracking 23.3% below the long term trend line while condo prices are down 25.4% from the peak.

On a year over year basis Chicago is still firmly in positive territory, though the one year price increase for single family homes has slowed down a bit, dropping back to 7.2%. However, condo prices were up a whopping 12.3% in the last year, which is close to an all time high since the condo index was established.

According to David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices:

Overall, the report shows that housing prices are rising but the pace may be slowing. Thirteen out of twenty cities saw their returns weaken from May to June. As we are in the middle of a seasonal buying period, we should expect to see the most gains. With interest rates rising to almost 4.6%, home buyers may be discouraged and sharp increases may be dampened. Other housing news is positive, but not as robust as last spring. Starts and sales of new homes continue to lag the stronger pace set by existing homes. Despite recent increases in mortgage interest rates, affordability is still good as credit qualifications have eased somewhat.

If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think I’m the next Kurt Vonnegut you can Subscribe to Getting Real by Email.