I’m not sure that Chicago foreclosure activity is going to rise to pre-pandemic levels any time soon, though Rick Sharga, the executive vice president of market intelligence at ATTOM, has a different take on things. When ATTOM released their October Foreclosure Market Report for the country a couple of weeks ago he pointed out that:

Even though foreclosure activity continues its slow, steady increase since the end of the government’s moratorium, we’re still far below normal levels. October foreclosure activity was about 59 percent of pre-pandemic numbers, and at its current pace foreclosures probably won’t be back to historically normal levels until sometime around mid-2023.

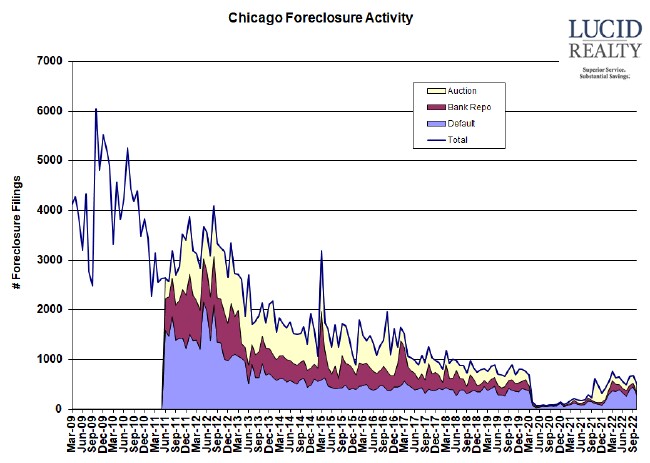

So the US foreclosure picture may be a bit different now than the Chicago picture. According to the ATTOM release US foreclosure activity was up 57% from a year ago. However, Chicago foreclosure activity was actually down 18% from a year ago. Looking at the graph of Chicago foreclosure activity below puts it all in perspective. First, note the month to month volatility which makes it hard to draw any conclusions without a long run of data. If you look at the graph carefully and try to see an upward trend in foreclosure activity then you will probably see it. But I’m not convinced that’s going to be a long term trend. And, although we’re actually running a bit below pre-pandemic levels, it’s nowhere near 40% below like the nation as a whole.

However, the foreclosure market report does have Illinois in the top spot for the highest foreclosure rate in the nation. I’m thinking it’s because prices haven’t risen as fast here as they have in the rest of the country and strong price appreciation discourages foreclosures. Likewise, Chicago is in the top 5 large metro areas. At least we are overachievers.

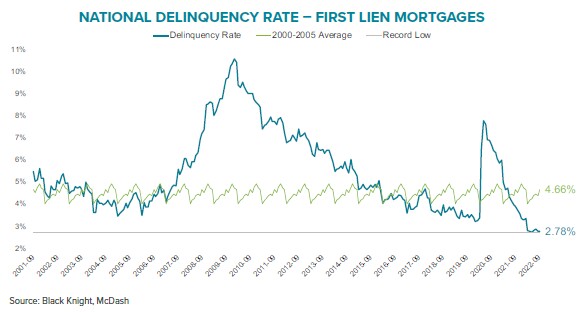

Once again, the reason I’m not convinced that we’re going to see a long term increase in foreclosure activity is that the delinquency rate is running at historic lows. The graph below from Black Knight’s September Mortgage Monitor Report highlights just how low the delinquency rate is in historic terms.

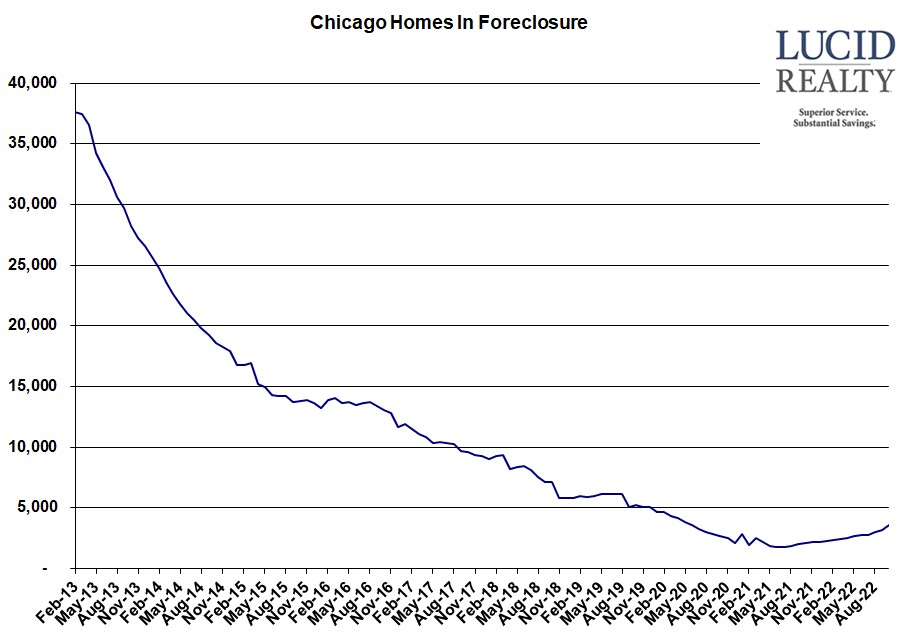

Chicago Shadow Inventory

Where we are seeing a clear upward trend is in the number of Chicago homes that are IN foreclosure but that’s not too surprising. The pipeline cleared out during the moratorium and now it’s filling again but at a very slow rate. Homes can be in the pipeline for quite a while – a year or two – but once the number of homes exiting the process equals the number of homes entering the process this should stabilize.