S&P Dow Jones Indices released the August Case Shiller home price indices for 20 cities, including Chicago, this morning and it shows continued strength in the housing market across the nation. Chicago’s single family home prices were up a solid 1.6% over July, which is very good since the price gains usually start to fall off at this time of year. Condominium prices were up 1.7%. These gains were pretty typical for the other 19 cities that Case Shiller tracks.

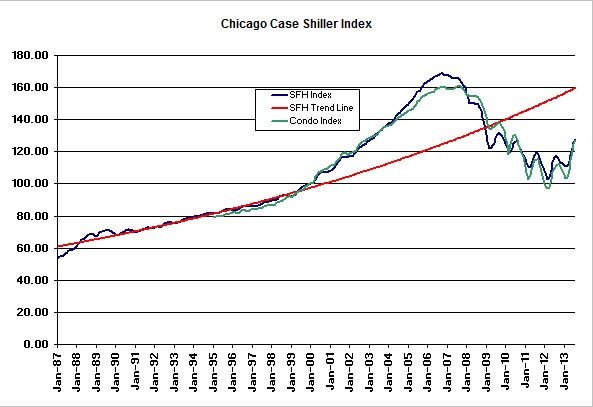

You can see the long term trend in Chicago home prices in the graph below. The August gains put single family home and condo prices at their highest level in about 3 1/2 years. But going back to bubble times the last time single family home prices were this low was February 2003 and for condominiums it was October 2002.

The lows in Chicago home prices occurred in March 2012. Since then single family home prices have risen by 24.2% and condo prices have risen by 30.4% – really nice gains. However, single family home prices are still 24.3% below the peak and condo prices are 21.2% below the peak. And compared to that red long term trend line in the graph above single family homes are still lagging by 20%.

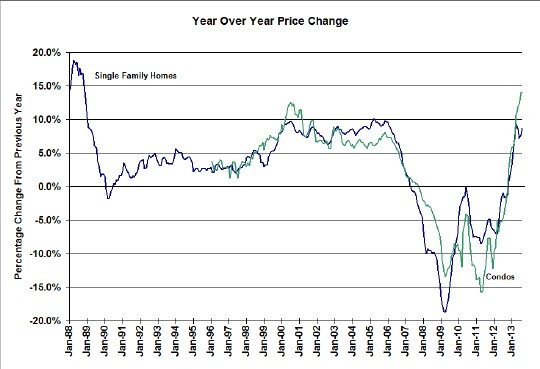

On a year over year basis both single family homes and condominiums are tracking at some of the highest gains of the last 13 years. Single family homes gained 8.7% in the last year and condos gained a whopping 14.1% – another record high for year over year condominium price gains.

What I find really interesting though is that Chicago’s year over year gains for single family home prices actually lag 16 of the 20 metro areas that Case Shiller tracks. Many of these 16 metro areas are solidly in the double digit gains. And interestingly enough Dallas and Denver home prices hit record highs. So that gives you some idea of what might be possible in Chicago still.

David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices, commented on the price strength at the national level:

The 10-City and 20-City Composites posted a 12.8% annual growth rate. Both Composites showed their highest annual increases since February 2006. All 20 cities reported positive year-over-year returns. Thirteen cities posted double-digit annual gains. Las Vegas and California continue to impress with year-over-year increases of over 20%.

If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think I’m the next Kurt Vonnegut you can Subscribe to Getting Real by Email. Please be sure to verify your email address when you receive the verification notice.