Lately when I check on the Case Shiller home price index for Chicago each month I anxiously wait to see if we can finally say that home prices have risen over last year. Alas, we have to wait for another month.

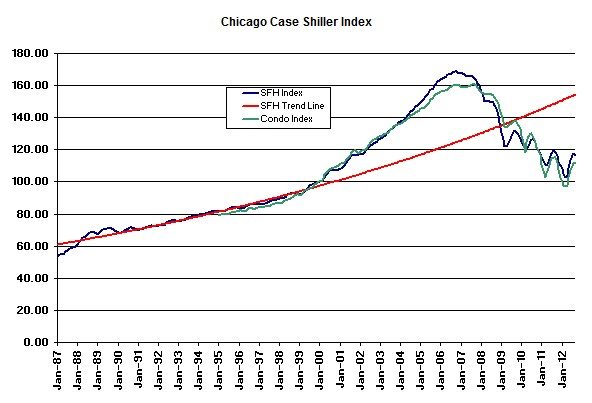

In September single family home prices dropped by 0.6%, which is normal at this time of year. However, condo prices actually rose by 0.9%. As you can see in the graph below we are at the beginning of the 5th dip since the housing bubble burst in Chicago. It’s just part of the normal seasonality but it has been much more dramatic since the bubble burst.

Single family home prices have now dropped a total of 30.8% since the bubble burst while condo prices have dropped a total of 30.3%. Single family home prices were at this level in September 2001. Condo prices were at this level in March/ April 2001. Relative to the long term trend line in red above prices are off by 24.5%.

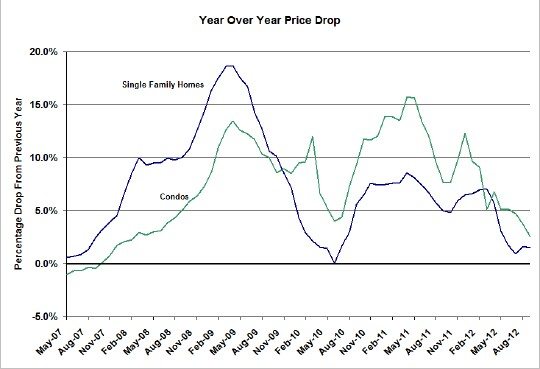

The graph below shows the year over year home price changes. Single family home prices are down 1.5% in the last year while condo prices are down 2.5%. Both indices keep flirting with turning positive on a year over year basis but just haven’t gotten there yet. Chicago is one of only 2 cities, out of the 20 which Case Shiller tracks, that has not yet turned positive over the previous year. The other city is New York. With activity as strong as it has been lately and inventory as low as it has been one would think we are on the verge of turning positive.

Speaking in reference to the national housing picture David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices, sounded a positive note: “With six months of consistently rising home prices, it is safe to say that we are now in the midst of a recovery in the housing market.”