Oh, the humanity! The Case Shiller home price index just came out for Chicago for the month of February and it’s more bad news for sellers (but good news for buyers). Single family home prices dropped by another 2.6% while condo prices fell by another 2.4%. Chicago was one of 9 cities where home prices hit a new post-crisis low.

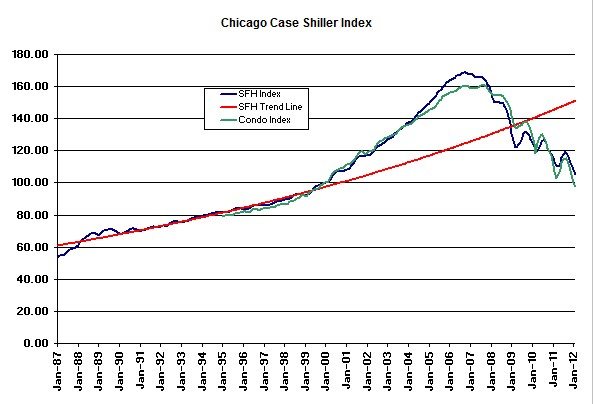

Granted, this is the time of year where prices tend to fall (the February numbers represent an average of December – February closings, which is a really soft time of year for housing in Chicago) BUT the February drop was larger than can be explained by normal seasonality. And just how low can prices go? Look at the chart below to see where we have been and where we are.

Note how far we have been running below the long term trend line – currently 30% below it. Single family home prices are now back to May/ June 2000 levels, while condo prices are back to September/October of 1999 prices. That’s 12 years without a gain in housing prices. And when I moved to Chicago back then everyone kept telling me to buy a house because Chicago real estate always goes up.

As an interesting side note the Case Shiller index is set to 100 for January 2000 so for the first time the condo index has broken below 100.

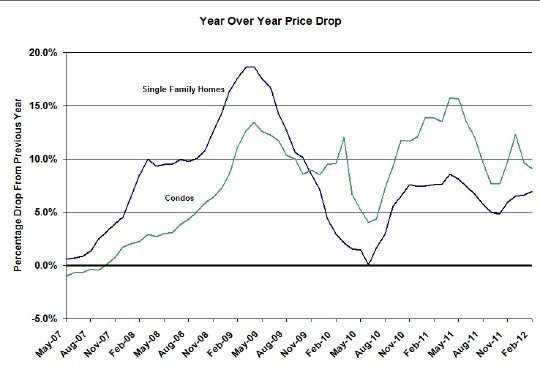

The total drop from the bubble peak is now 37.5% for single family homes and 39.3% for condos. On a year over year basis the drop is 6.9% and 9.1% respectively. The year over year drop is graphed below and has been continuous ever since the bubble burst.

However, there are some recent positive signs (for sellers) in that demand seems to be up while supply is down.

If you are interested we maintain a page of on our Web site that contains this pricing data along with numerous other Chicago real estate market data all in one place. Actually, we maintain this page even if you are not interested.