A couple of days ago the Cook County Clerk’s office released the 2016 property tax rates for Chicago and the suburbs and it was another double digit increase primarily driven by…no surprise…an urgent need to fund the city’s deficient pension funds. And this is despite an increasing tax base in the county. All because previous city administrations agreed to pension obligations and then didn’t properly fund them.

Approximately 20% of the tax increase for the average residential tax bill in the City of Chicago is due to an increase in pension levies by the City of Chicago. This is the second year of a planned four-year levy increase. Another 60% of the 2016 increase is due to the new pension fund levied by the Chicago Board of Education, authorized last year by Public Act 99-0521. The remainder is due to the typical, more moderate levy increases of other taxing districts.

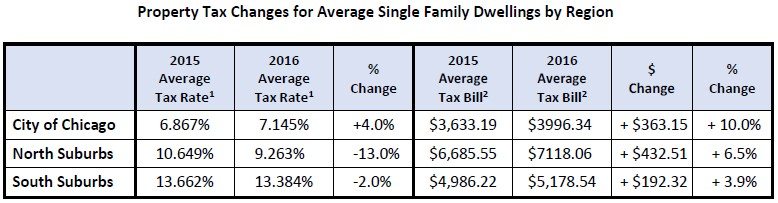

The table below, extracted from the report, shows how the average tax bill will be impacted in Chicago and the suburbs based on the average value of homes in the respective areas. Ignore the first 3 columns as they don’t tell you the whole story. The bottom line is that Chicago property tax bills will be going up by 10.0% or $363 for an average $224,500 home – well, not exactly. See below.

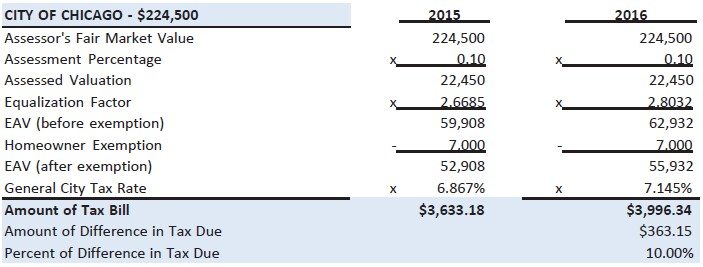

The report also provides the following breakdown of how the impact comes out to 10.0%. It’s a combination of an increase in the equalization factor and the general city tax rate but that assumes the homeowner’s exemption on a fairly modestly priced home.

The report also provides the following breakdown of how the impact comes out to 10.0%. It’s a combination of an increase in the equalization factor and the general city tax rate but that assumes the homeowner’s exemption on a fairly modestly priced home.

I prefer to combine all the factors into a single percentage, pre-exemption, and then talk about the impact of the exemption separately. The reason is that I always tell our buyer clients to focus on what their property taxes will most likely become when the county goes through a reassessment instead of what the property taxes are at the time of sale. Using a single factor makes it a lot easier for them to run through that math in their head.

I prefer to combine all the factors into a single percentage, pre-exemption, and then talk about the impact of the exemption separately. The reason is that I always tell our buyer clients to focus on what their property taxes will most likely become when the county goes through a reassessment instead of what the property taxes are at the time of sale. Using a single factor makes it a lot easier for them to run through that math in their head.

For 2015 property taxes were essentially 1.83% of what Joseph Berrios thought your home was worth. In 2016 that percentage is now 2.00% or a 9.3% increase. Again, that is before the homeowner’s exemption which is now worth around $500 in reduced taxes due to an increase in the general city tax rate. If you play with the numbers enough what you will see is that once you factor in the exemption the net percentage increase in taxes depends upon the value of the home. For very expensive homes the increase approaches 9.3% but as the value of the home goes down the percentage increase in taxes goes up above 9.3% and can become quite enormous.

2016 Cook County tax bills will probably be mailed July 1, 2017 and payment will be due August 1.

#ChicagoPropertyTaxes #CookCountyPropertyTaxes #PropertyTaxes

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service discount real estate brokerage. If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think he’s the next Kurt Vonnegut you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.