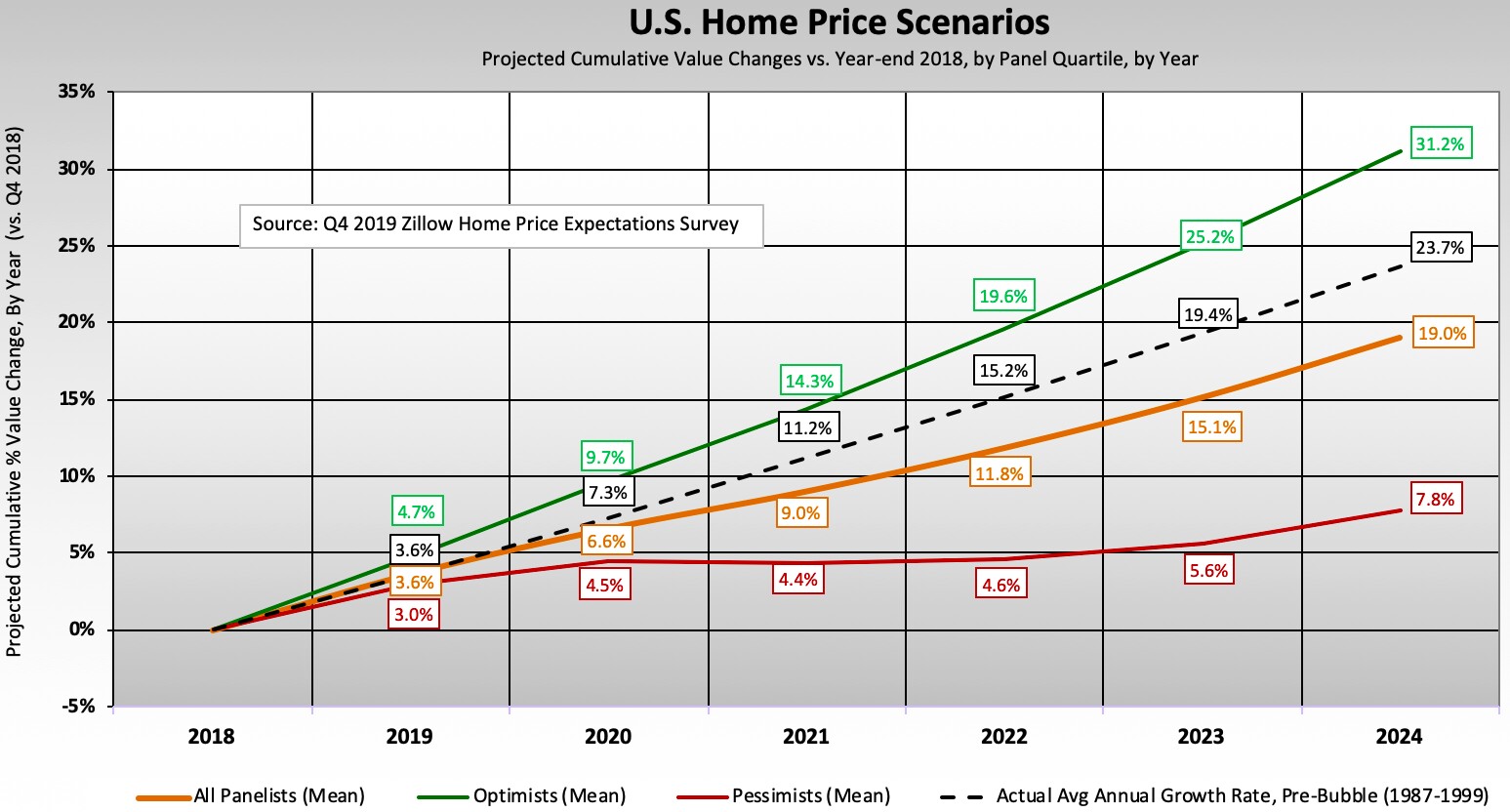

Last week Zillow and Pulsenomics released their 4th quarter home price expectations survey based upon input from over 100 real estate experts. With this release they’ve tacked on another year – 2024. You can see the summary in the graph below. For the 5 years ending in 2023 their cumulative predicted return is identical to where it was last quarter although their 2020 forecast is now reflecting 2.9% growth up from a 2.5% prediction last quarter. When you look at the 6 year period their average predicted return is also 2.9% per year compounded.

Pulsenomics Founder Terry Loebs discussed the dispersion among the individual home price forecasts and how it has increased over the past decade:

We’re in the eighth year of the supposed housing recovery, but persistent uncertainty about the relative appeal and affordability of homeownership, future housing policies and supply trends leaves the experts far from a consensus.

The experts’ predictions for nationwide home prices in 2020 range from 7.4% growth to 3.0% contraction, and increased divergence in longer-run expectations also confirms that market conditions remain far from settled. Our most optimistic group of experts expects 31.2% cumulative home value appreciation through 2024, while our most pessimistic group expects a cumulative gain of just 7.8% over the same period…We’ve been conducting this survey for more than ten years, and this barometer of housing market malaise is now at a record-high level.

As is often the case they asked a few supplemental questions which included a couple pertaining to the outlook for various metro areas – whether they are expected to underperform or outperform the national average in 2020 and whether prices in each metro area are expected to fall in 2020. I would love to tell you what they said about Chicago but apparently these clowns didn’t think Chicago was worth including, although Jacksonville, Columbus, and several other cities smaller than Chicago were included?!?!?!?!?!

Chicago Area Home Price Outlook

If we want to know how Chicago home prices are expected to perform over the next few years our best bet is to look at the Case Shiller home price futures market. Trading of futures contracts on the Case Shiller index for Chicago tells us what the “wisdom of crowds” has to say about this.

Unfortunately I wasn’t able to get my hands on a graph this time but I can describe the implied forecast for you in one word: flat. Chicago home prices aren’t expected to go much of anywhere over the next 5 years. Looking at the November 2024 contract I see that the market is estimating a 0.7% average annual compounded rate of appreciation, which is about where we were at the last Case Shiller index release. And that’s actually lower than when I looked at these contracts for the 3rd quarter report.

#ChicagoHomePrices #HomePrices #HomePriceForecast #Pulsenomics

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service real estate brokerage that offers home buyer rebates and discount commissions. If you want to keep up to date on the Chicago real estate market or get an insider’s view of the seamy underbelly of the real estate industry you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.