Each year the Chief Investment Office of UBS analyzes the housing markets in the top global cities to determine their degree of over or under valuation in order to identify real estate markets at the highest risk of being in a bubble. Chicago has consistently ranked at the bottom of the list – i.e. it has the most undervalued housing market in the world. The 2020 UBS Global Real Estate Bubble Index report was no exception.

The report states that “the UBS Global Real Estate Bubble Index traces the fundamental valuation of housing markets, the valuation of cities in relation to their country and economic distortions (lending and building booms)….[It’s] a weighted average of five standardized city sub-indices”:

- Price-to-income

- Price-to-rent

- Change in mortgage-to-GDP ratio

- Change in construction-to-GDP ratio

- Relative price-city-to-country indicator

They are looking for “patterns of property market excesses” which would manifest as “a decoupling of prices from local incomes and rents, and imbalances in the real economy, such as excessive lending and construction activity.”

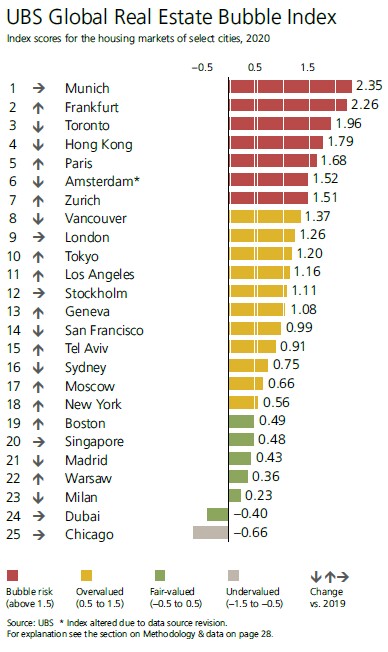

They ranked 25 global housing markets and categorized them into 5 different buckets depending on their index/ bubble risk levels as shown below. Notice that Chicago is actually the only city in the undervalued bucket.

The report notes that the majority of the high bubble risk cities are in Europe and they attribute that to the fact that Europe has exceptionally low interest rates. The report also notes that population shifts out of urban centers could spell trouble for some of the global cities.

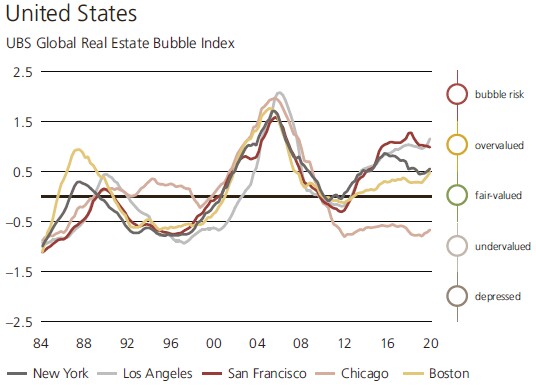

The graph below shows how the 5 US cities have trended over time. None of them are currently categorized as bubble risks, though 3 are overvalued and Boston is almost overvalued. Although all 5 cities tended to trend together over much of this time frame Chicago definitely went on its own undervalued path after the housing bubble burst.

The UBS report is not that optimistic about future price appreciation in Chicago but they do highlight just how affordable the city is:

With the city highly indebted, employment growth depressed, and the population declining, a turnaround is unlikely in the near future. However, affordability remains intact, as incomes are keeping pace with the slow price increases. A skilled worker needs only three years of income to be able to afford a 60 square meter (650 square foot) flat near the city center – the lowest figure among all cities included in the study.

Chicago’s low price to income ratio, along with the low price to rent ratio, are two factors that play a big role in Chicago standing out as affordable and with a low risk of being in a real estate bubble.

#ChicagoHomePrices #HousingBubble #BubbleIndex #ChicagoRealEstate

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service real estate brokerage that offers home buyer rebates and discount commissions. If you want to keep up to date on the Chicago real estate market or get an insider’s view of the seamy underbelly of the real estate industry you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.