Maybe a week or so ago I received a notice in the mail from the Cook County Assessor’s office explaining that they had lowered my home’s assessed tax value in light of the Coronavirus pandemic. I got about a 9% reduction.

My first question was “Why are they doing this?” because I’ve seen no evidence that property value are going down by that amount – unless maybe you are in a condo in “downtown” Chicago. My second question was “Why are they doing this?” because if everyone’s assessed value goes down then, on average, nobody really benefits – just those whose values go down more than the average. And I’m not sure I’d expect one part of the county, or one home, to have a significantly larger impact from Covid-19.

Let me explain that last point and refer you back to my annual summary of the Cook County property tax rate calculation. The city/ county are going to collect whatever property taxes they need to cover their budget. They spread that amount over all the property values in the county and that’s how they get the tax rate. If the aggregate property values go down then the tax rate just goes up to compensate for that. The only way to win at the tax assessment game is to get a bigger reduction in value than everyone else.

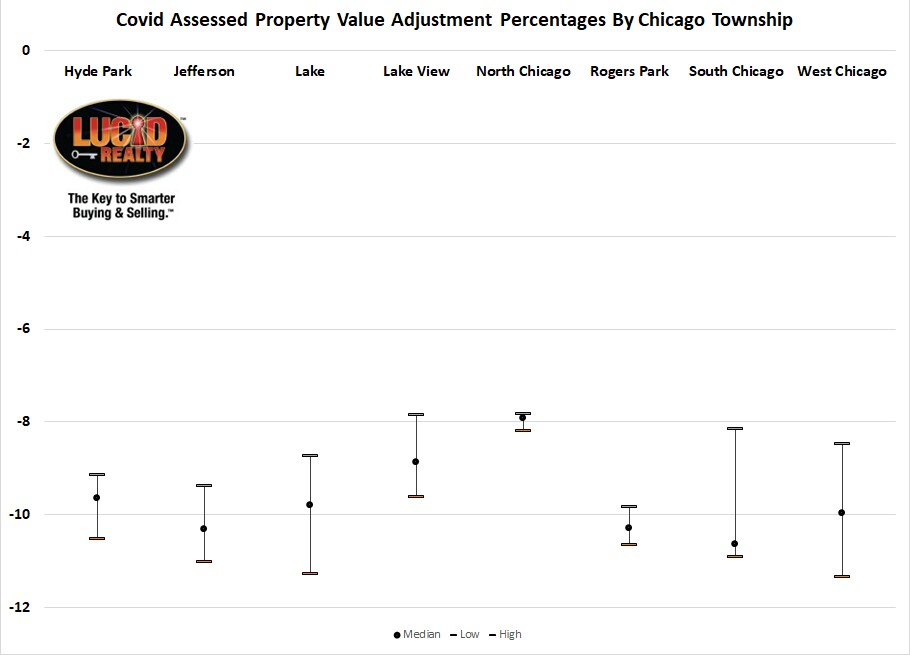

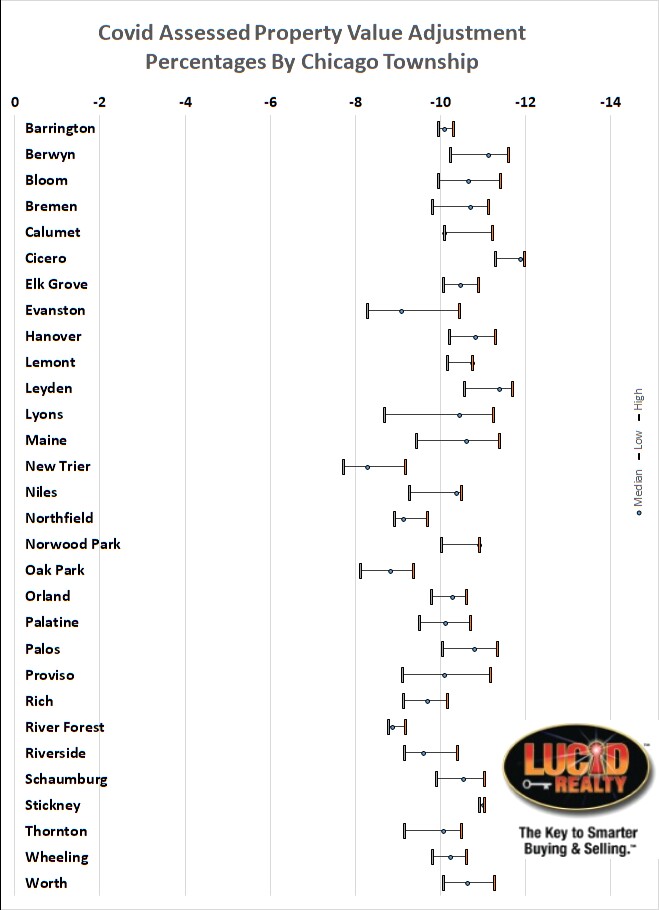

So the assessor’s office actually produced a nice summary by township of the median reduction and the 10th and 90th percentile reduction. I’ve graphed them below, first for the Chicago townships and then for the suburban ones.

As you can see in the graph most of the adjustments fell between -8% – -11.5%. What’s odd is that North Chicago got one of the lowest adjustments despite including an area (the Near North Side) that is seeing a lot of condo selling this year. Anyway, the takeaway for me is that my 9% reduction is actually on the low side so I might actually see an increase in property taxes for 2020. That’s on top of whatever increase is coming to cover our budget disaster.

Here are the Cook County suburban township results graphed. Because there are so many I had to turn the graph sideways. But the ranges of the adjustments are similar to what we have for Chicago – maybe even a bit more – despite the fact that the suburbs are believed to be on fire right now. Property taxes don’t make much sense.

I won’t fault Fritz Kaegi too much for these anomalies. He’s doing a much better job than Joe Berrios ever did. Fritz’ value estimates were mostly based on employment data for the various areas and this process was kicked off a while ago. How was he supposed to know that the suburbs would undergo an unprecedented resurgence as a result of the pandemic and social unrest?

#PropertyTaxes #Covid19 #Coronavirus

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service real estate brokerage that offers home buyer rebates and discount commissions. If you want to keep up to date on the Chicago real estate market or get an insider’s view of the seamy underbelly of the real estate industry you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.