RealtyTrac released their June Foreclosure Market Report this morning, which also includes their perspective on the first half of 2016, and the data for Chicago is similar to what we’ve seen for several months now. Overall activity was down from a year ago – as it has been for 43 out of the past 44 months – but there was no significant change in the activity level from the most recent months with one important exception. Default activity, which is what feeds the foreclosure pipeline, hit another record low since I’ve been tracking the data. However, it beat the previous record by only a small amount.

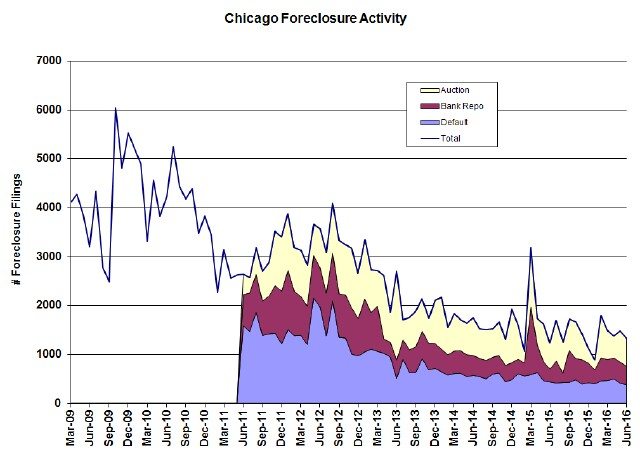

The graph below shows the trend since early 2009.

Chicago was one of the 10 metro areas with the highest foreclosure rates in the country in the first half of this year, though it did rank in 10th place. RealtyTrac also highlighted Illinois in one of their graphs which shows some of the states that had 2nd quarter foreclosure activity still higher than pre-recession levels – 36% higher in the case of Illinois, though it’s more than 64% lower than the peak activity.

RealtyTrac reported that the nation’s foreclosure activity in the first six months of 2016 was down 20 percent from the previous six months and down 11 percent from last year. Daren Blomquist, senior vice president at RealtyTrac, commented about the nation’s overall foreclosure activity:

Although there are some local outliers, the downward foreclosure trend continued in the first half of 2016 in most markets nationwide. While U.S. foreclosure activity is still above its pre-recession levels, many of the states hit hardest by the housing crisis have now dropped below pre-recession foreclosure activity levels. With some exceptions, states with foreclosure activity continuing to run above pre-recession levels tend to be those with protracted foreclosure timelines still working through legacy distress from the last housing bust.

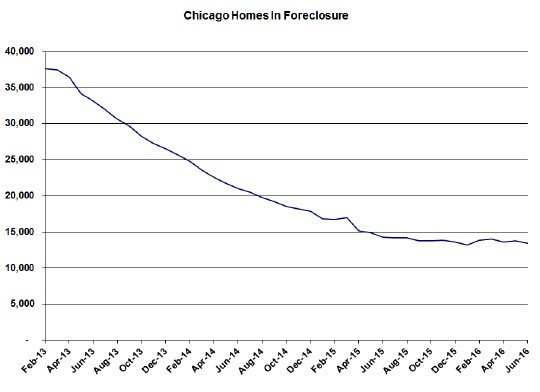

Chicago Shadow Inventory

The number of Chicago homes that are in the foreclosure process (the shadow inventory) has been pretty stagnant for months as you can see in the graph below. That’s not really good because these homes are not well maintained and they are often a blight on the neighborhood, not to mention the affect of the potential inventory overhang – e.g. will a bunch of them hit the market all at once at some point in the future?

Another interesting graph from this month’s report shows that the share of investor purchases at auction hit a 17 year high at 27%. How the heck they can tell who is an investor I have no idea.

#ChicagoForeclosures #Foreclosures

Gary Lucido is the President of Lucid Realty, the Chicago area’s full service discount real estate brokerage. If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think he’s the next Kurt Vonnegut you can Subscribe to Getting Real by Email using the form below. Please be sure to verify your email address when you receive the verification notice.