At this rate the pain of the current housing crisis is never going to end. RealtyTrac just came out with their April Foreclosure Market Report and on a national basis foreclosure activity reached a 40 month low as a result of “massive delays” in the foreclosure process, NOT because of any improvement in the housing market. Apparently the delays are at least partly due to the banks having to work through their documentation problems. Here are a few highlights from the press release:

- Loans that are more than 90 days delinquent are no longer automatically going “into foreclosure but are waiting longer to allow for loan modifications, short sales and possibly other disposition alternatives.”

- Once a loan moves into the foreclosure process it’s taking longer to complete the process.

- The total foreclosure timeline has steadily worsened – from 151 days in the first quarter of 2007 to 340 days in the first quarter of 2010 to 400 days in the first quarter of 2011.

- Illinois was one of the top 10 states for foreclosure activity in April. (Go Illinois!)

The fact that lenders are first pursuing alternatives to foreclosure is probably a good thing. The fact that the rest of the process is taking so long is not a good thing. God knows we need to get this mess over with ASAP.

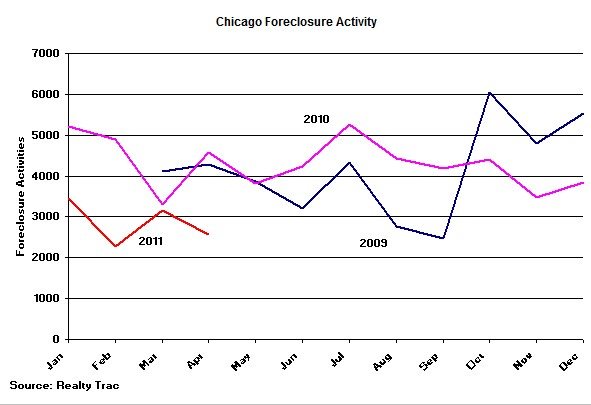

For Chicago foreclosure activity remains subdued compared to the last 2 years as shown in the graph below. However, April activity did not fall below the low reached in February.