The Chicago real estate market took a pretty big hit in May, with sales declining by the largest year over year percentage since June 2011 – down 13.5%. That marks the 5th month in a row that sales declined from the previous year. In two weeks the Illinois Association of Realtors (IAR) will report a slightly worse decline – down by 15.7%.

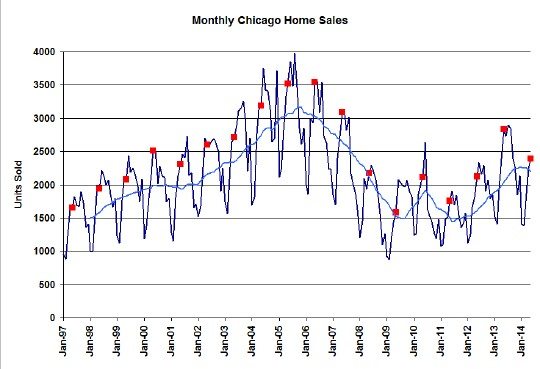

In the graph below you can see monthly Chicago home sales going back to 1997, with all the previous May data flagged in red and a moving average in blue. The moving average has turned down in the last few months. However, May of this year is still above 5 of the last 6 years and somewhere between 2001 and 2002 levels. Who knows if we will reach bubble years’ sales levels any time soon.

Now if you are impressed by such things you can also note that the IAR will report median selling prices up 14.9% but that’s kind of a bogus number anyway, as I have often pointed out.

Chicago Home Contract Activity

You can see the decline in contract activity that has been causing the decline in sales in the graph below. May was down 7.8% from last year, after estimating the number of contracts that won’t make it to closing, and you can also see how the moving average has turned down recently. So this would indicate continued soft sales for at least the next month or two.

Pending Home Sales

The other component of the sales equation is pending home sales. The math works as follows: home sales = contracts written – contracts cancelled – change in pending home sales. If pending home sales go up then it basically reduces the sales in the current month, but saves them up for a later time. At this time of year pending home sales do go up because of the increasing activity level. In the graph below I express the pending home sales in terms of how many months of closings it would support at the current level of closings. It typically runs around 2.5 months. May declined slightly from April.

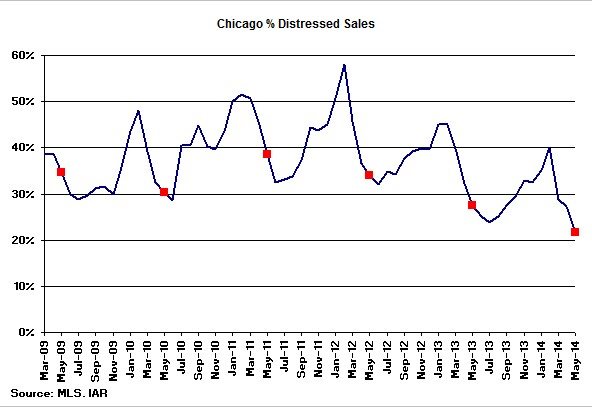

Distressed Home Sales

Now this is really interesting. As the bubble burst a pretty significant percentage of sales were distressed properties. As you can see in the graph below this percentage has really dropped off significantly and keeps hitting new lows. In May only 21.6% of total home sales were distressed. This decline in distressed sales is really substantially contributing to the decline in overall home sales. For instance, in May fully 55% of the decline in sales came from the decline in distressed sales, and that’s a lot when you consider that the distressed sales are way less than half the total sales at this time of year.

So if you think you are going to come in and steal a short sale or bank owned property think again. The door is closing on that opportunity.

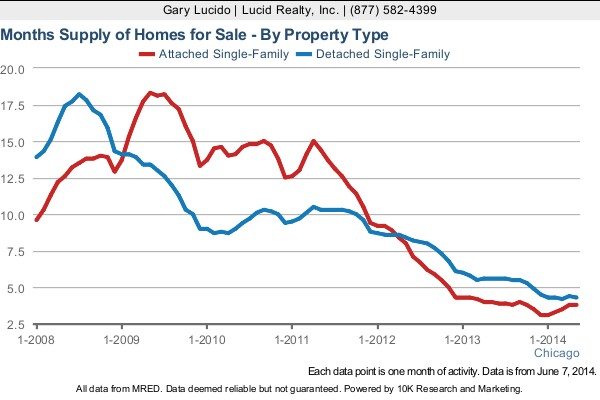

Chicago Home Inventory

The inventory situation is getting to be a bit of a mystery to me and I’m going to dig into it a bit more. It turns out that inventory levels remain extremely low despite declining sales and increasing listing activity. That’s right. More properties are being listed now than last year. So I’m thinking that maybe more people are testing the waters and then getting discouraged and cancelling their listings. I’ll let you know what I find out.

But as you can see below single family home inventories seem to have bottomed out at a very low level – most recently a 4.3 month supply of homes – and condo/ townhome inventory levels have actually risen a bit but remain very low – only a 3.8 month supply. Clearly these exceptionally low inventory levels are what is fueling the price increases and it’s also contributing to the decline in sales.

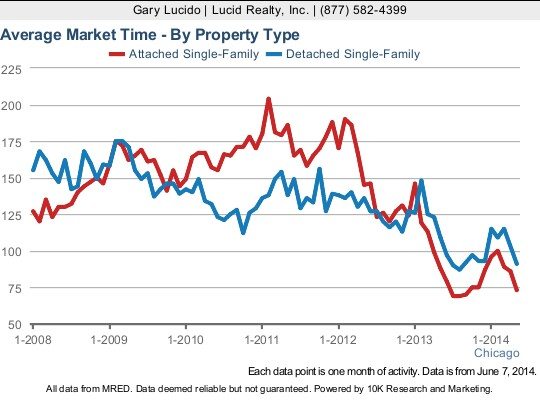

Chicago Home Sale Market Times

And when inventory levels are this low it’s a cinch to sell homes. Look how fast they are selling, when in fact they sell. In May single family homes sold in 91 days and condos/ townhomes sold in only 73 days on average. And yet people are paying their realtors 6% to sell their homes? I don’t get it. But then again you know what H. L. Mencken said.

If you want to keep up to date on the Chicago real estate market, get an insider’s view of the seamy underbelly of the real estate industry, or you just think I’m the next Kurt Vonnegut you can Subscribe to Getting Real by Email. Please be sure to verify your email address when you receive the verification notice.