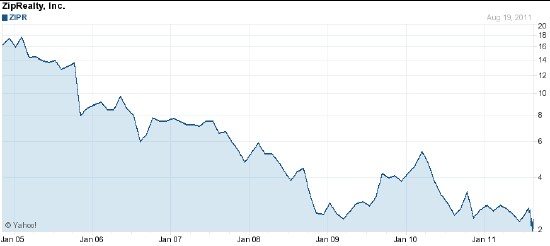

I think it’s becoming increasingly clear that the real estate brokerage formerly known as a discount brokerage, Zip Realty, is struggling and may not survive. If for no other reason all you have to do is look at their stock price which has been on a steady downward trajectory ever since they went public in November 2004:

If you had the money sitting around all you would need is about $44 MM to buy the whole company – about 1/8 of what it would have cost back when it went public.

Zip Realty announced their second quarter earnings a couple of weeks ago and the picture remains bleak:

- Revenue is down 37%, partially as a result of their previously announced exit from several markets. However, even in those markets where they remain their revenue is down 25%.

- They lost a lot more money this quarter than they did the previous year – $972,000 vs. $225,000.

- They dumped 32% of their agents in the last year as a result of their retrenchment

- In the last 6 months their operating activities have consumed about $7.3 MM cash. In total they only have about $24 MM cash left.

Not to mention that they’ve stopped giving buyer rebates, which will make it that much harder for them to get clients.

Apparently they are looking to make further operating expense cuts. If they can turn a profit then the death watch will be called off but these guys have a high overhead model so I’m skeptical.

I wouldn’t count them “down and out” just yet. You’ll have to stay tuned to “the rest of the story”.